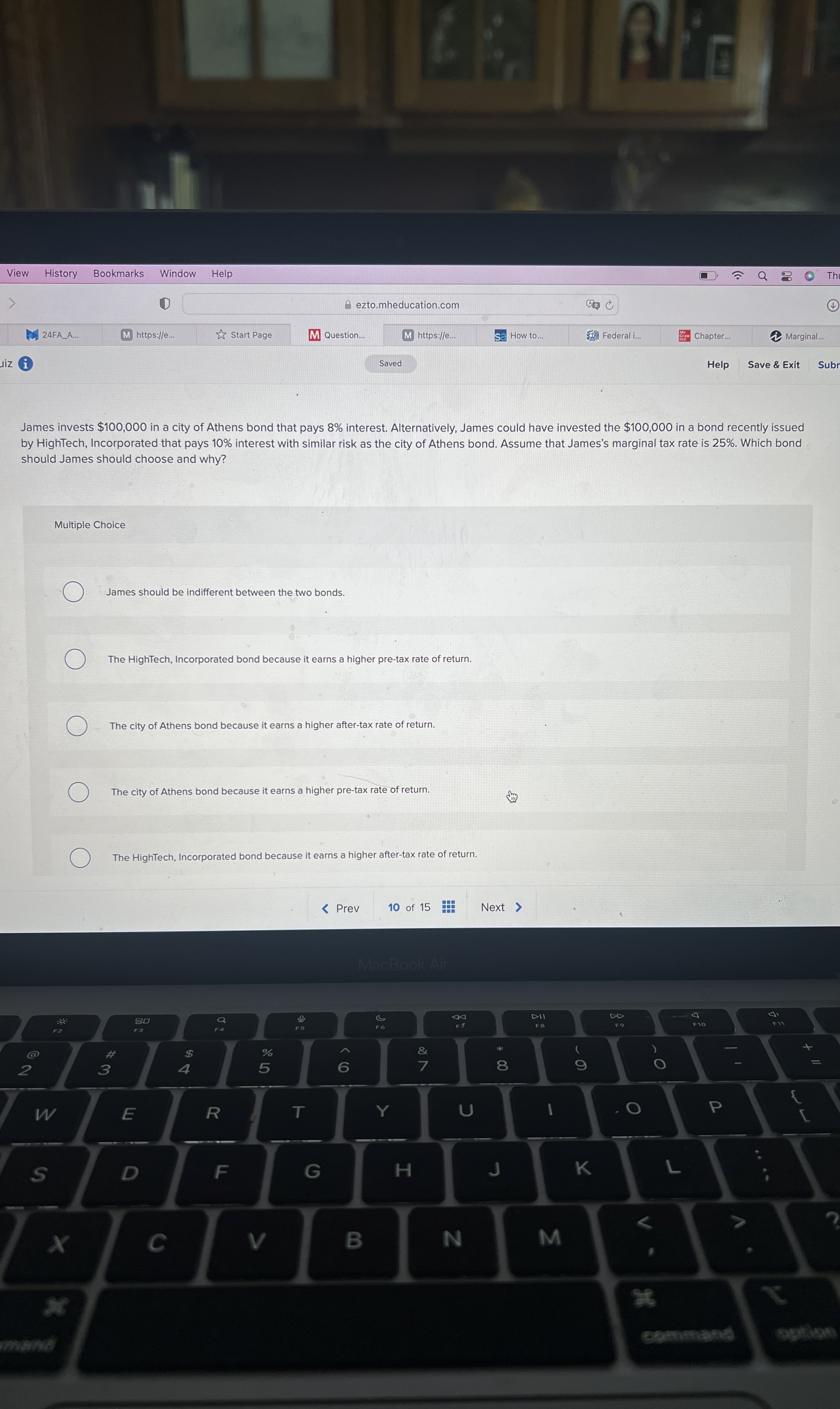

Question: James invests $ 1 0 0 , 0 0 0 in a city of Athens bond that pays 8 % interest. Alternatively, James could have

James invests $ in a city of Athens bond that pays interest. Alternatively, James could have invested the $ in a bond recently issued

by HighTech, Incorporated that pays interest with similar risk as the city of Athens bond. Assume that James's marginal tax rate is Which bond

should James should choose and why?

Multiple Choice

James should be indifferent between the two bonds.

The HighTech, Incorporated bond because it earns a higher pretax rate of return.

The city of Athens bond because it earns a higher aftertax rate of return.

The city of Athens bond because it earns a higher pretax rate of return.

The HighTech, Incorporated bond because it earns a higher aftertax rate of return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock