Question: Jamie Dermott: mutually exclusive project analysis Jamie Dermott graduated from RMIT University in December Give me your thoughts on these two projects by 9 am.

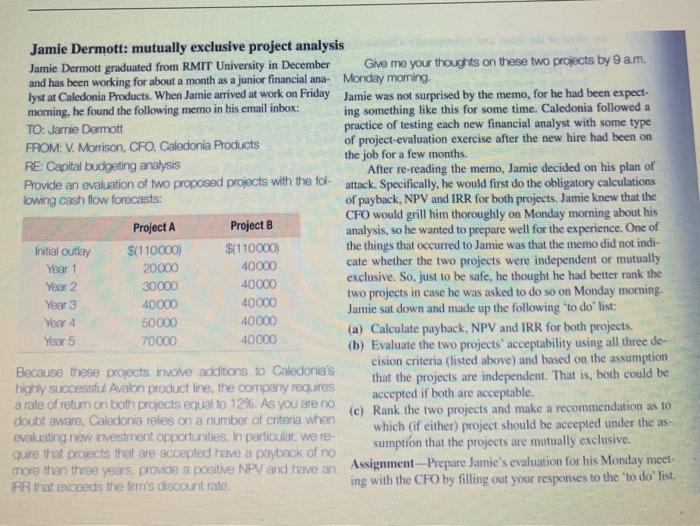

Jamie Dermott: mutually exclusive project analysis Jamie Dermott graduated from RMIT University in December Give me your thoughts on these two projects by 9 am. and has been working for about a month as a junior financial ana- Monday morning. lyst at Caledonia Products. When Jamie arrived at work on Friday Jamie was not surprised by the memo, for he had been expect- morning, he found the following memo in his email inbox: ing something like this for some time. Caledonia followed a TO: Jamie Dermott practice of testing each new financial analyst with some type FROM: V. Morrison, CFO, Caledonia Products of project-evaluation exercise after the new hire had been on the job for a few months. RE Capital budgeting analysis After re-reading the memo, Jamic decided on his plan of Provide an evaluation of two proposed projects with the fol- attack. Specifically, he would first do the obligatory calculations lowing cash flow forecasts: of payback, NPV and IRR for both projects. Jamie knew that the CFO would grill him thoroughly on Monday morning about his Project A Project B analysis, so he wanted to prepare well for the experience. One of Initial outlay $(110000) $(110000) the things that occurred to Jamie was that the memo did not indi- Year 1 20000 40000 cate whether the two projects were independent or mutually Year 2 30000 40000 exclusive. So, just to be safe, he thought he had better rank the Year 3 two projects in case he was asked to do so on Monday morning. 40000 40000 Jumic sit down and made up the following to do list: Year 4 50000 40000 Year 5 (a) Calculate payback, NPV and IRR for both projects, 70000 40000 (b) Evaluate the two projects acceptability using all three de- cision criteria (listed above) and based on the assumption Because these projects involve additions to Caledonia's highly successful Avalon product line, the company requires that the projects are independent. That is, both could be a rate of return on both projects equal to 12%. As you are to accepted if both are acceptable. doubt aware, Caledonia relies on a number of criteria when (c) Rank the two projects and make a recommendation as to evaluating new rivestirent opportunities. In particular, were which (if either) project should be accepted under the as- qure that projects that are accented have a payback of no sumption that the projects are mutually exclusive more than three years provide a positive NPV and we an Assignment - Prepare Janie's evaluation for his Monday meet RR that exceeds the firm's discount rate ing with the CFO by filling out your responses to the 'to do list

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts