Jamie Lee Jackson, age 25, a busy full-time student and part-time bakery clerk, has been trying...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

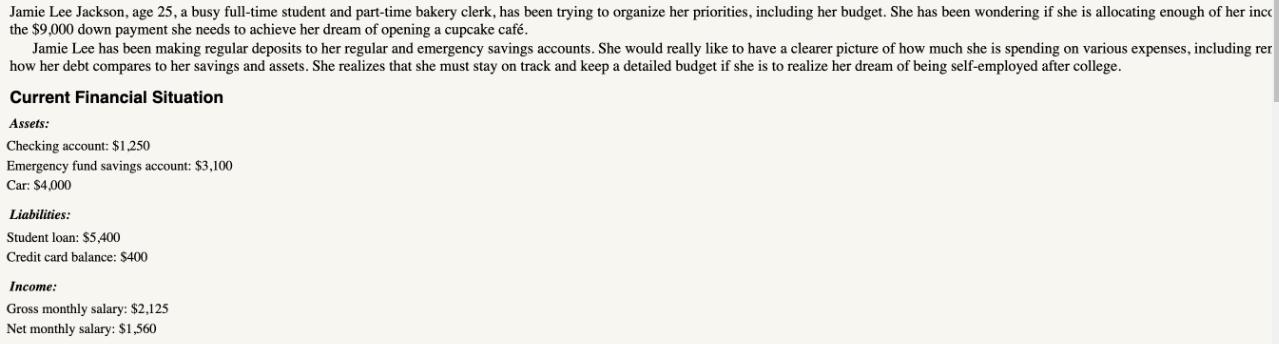

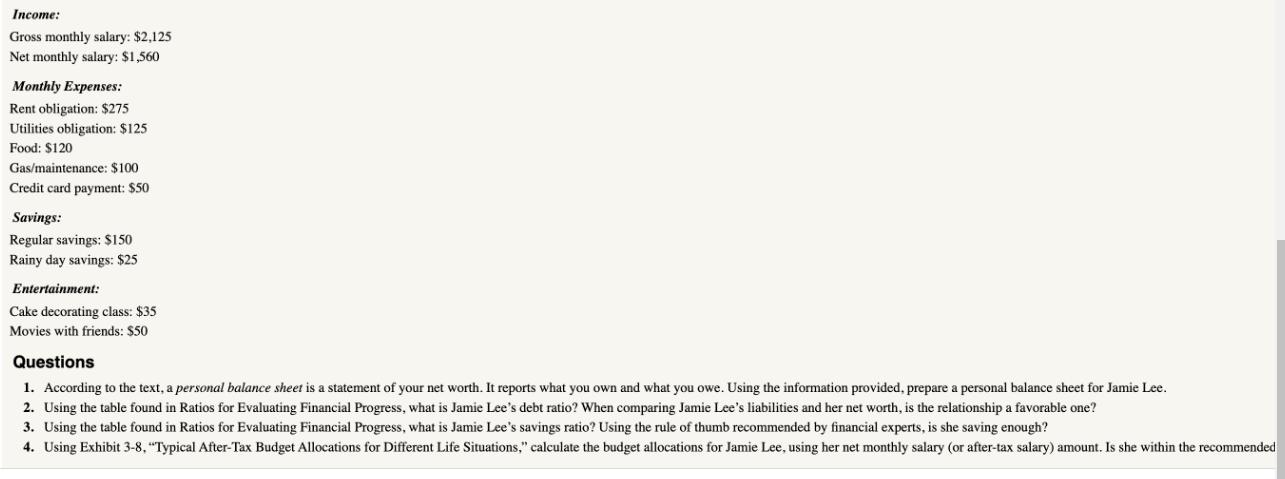

Jamie Lee Jackson, age 25, a busy full-time student and part-time bakery clerk, has been trying to organize her priorities, including her budget. She has been wondering if she is allocating enough of her inco the $9,000 down payment she needs to achieve her dream of opening a cupcake caf. Jamie Lee has been making regular deposits to her regular and emergency savings accounts. She would really like to have a clearer picture of how much she is spending on various expenses, including rer how her debt compares to her savings and assets. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college. Current Financial Situation Assets: Checking account: $1,250 Emergency fund savings account: $3,100 Car: $4,000 Liabilities: Student loan: $5,400 Credit card balance: $400 Income: Gross monthly salary: $2,125 Net monthly salary: $1,560 Income: Gross monthly salary: $2,125 Net monthly salary: $1,560 Monthly Expenses: Rent obligation: $275 Utilities obligation: $125 Food: $120 Gas/maintenance: $100 Credit card payment: $50 Savings: Regular savings: $150 Rainy day savings: $25 Entertainment: Cake decorating class: $35 Movies with friends: $50 Questions 1. According to the text, a personal balance sheet is a statement of your net worth. It reports what you own and what you owe. Using the information provided, prepare a personal balance sheet for Jamie Lee. 2. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's debt ratio? When comparing Jamie Lee's liabilities and her net worth, is the relationship a favorable one? 3. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's savings ratio? Using the rule of thumb recommended by financial experts, is she saving enough? 4. Using Exhibit 3-8, "Typical After-Tax Budget Allocations for Different Life Situations," calculate the budget allocations for Jamie Lee, using her net monthly salary (or after-tax salary) amount. Is she within the recommended Jamie Lee Jackson, age 25, a busy full-time student and part-time bakery clerk, has been trying to organize her priorities, including her budget. She has been wondering if she is allocating enough of her inco the $9,000 down payment she needs to achieve her dream of opening a cupcake caf. Jamie Lee has been making regular deposits to her regular and emergency savings accounts. She would really like to have a clearer picture of how much she is spending on various expenses, including rer how her debt compares to her savings and assets. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college. Current Financial Situation Assets: Checking account: $1,250 Emergency fund savings account: $3,100 Car: $4,000 Liabilities: Student loan: $5,400 Credit card balance: $400 Income: Gross monthly salary: $2,125 Net monthly salary: $1,560 Income: Gross monthly salary: $2,125 Net monthly salary: $1,560 Monthly Expenses: Rent obligation: $275 Utilities obligation: $125 Food: $120 Gas/maintenance: $100 Credit card payment: $50 Savings: Regular savings: $150 Rainy day savings: $25 Entertainment: Cake decorating class: $35 Movies with friends: $50 Questions 1. According to the text, a personal balance sheet is a statement of your net worth. It reports what you own and what you owe. Using the information provided, prepare a personal balance sheet for Jamie Lee. 2. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's debt ratio? When comparing Jamie Lee's liabilities and her net worth, is the relationship a favorable one? 3. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's savings ratio? Using the rule of thumb recommended by financial experts, is she saving enough? 4. Using Exhibit 3-8, "Typical After-Tax Budget Allocations for Different Life Situations," calculate the budget allocations for Jamie Lee, using her net monthly salary (or after-tax salary) amount. Is she within the recommended

Expert Answer:

Related Book For

Focus On Personal Finance

ISBN: 9780077861742

5th Edition

Authors: Jack R. Kapoor, Les R. Dlabay Professor, Robert J. Hughes, Melissa Hart

Posted Date:

Students also viewed these finance questions

-

With reference to the latest Annual Report of the Bank Islam Malaysia, discuss credit exposure of the bank by industry. Subsequently provide an assessment on the impact of the recent flood disaster...

-

1. According to the text, a personal balance sheet is a statement of your net worth. It is an accounting of what you own as well as what you owe. Using the information provided, prepare a personal...

-

4. What are the three categories of transactions in the balance of payments? Give an example of each. 5. Economists sometimes say that the current exchange rate system is a dirty float system. What...

-

RAK, Inc., has no debt outstanding and a total market value of $165,000. Earnings before interest and taxes, EBIT, are projected to be $21,000 if economic conditions are normal. If there is strong...

-

Assume that a sample of bivariate data yields the correlation coefficient, r, indicated. Use Table 12.9 for the specified sample size and level of significance to determine whether a linear...

-

Pick a product like Cadillac or Sara Lee Deli products or service like Mr. Clean Performance Car Wash or a car and home insurance company that is offered in a limited number of countries. Assess the...

-

Management of the First Syracuse Bank is concerned about a loss of customers at its main office downtown. One solution that has been proposed is to add one or more drive-through teller stations to...

-

Pops Popcorn has three project choices for the coming year, but only $9,000 in its budget for new projects. Project 1 is a new corn seed separator that identifies grannies (seeds that do not pop when...

-

Prove that the energy of a trapped particle is quantized. Find the possible relations.

-

A person who has been granted immunity from prosecution cannot be compelled to answer any questions. (True/False)

-

According to utilitarianism, it does not matter how many people benefit from an act.(True/False)

-

Ed sends to Sax, Inc., a written order for software to be specially designed, offering a certain amount of money. If Sax does not respond, it can be considered to have accepted the offer a. after a...

-

A promise to do what one already has a legal duty to do is not legally sufficient consideration under most circumstances. (True/False)

-

Pleadings consist of a complaint, an answer, and a motion to dismiss.(True/False)

-

Write a method mixIt, that receives 2 strings and returns a string containing the first char of string1, the first char of string2, the second character of string1, the second character of string2...

-

A sprinkler head malfunctions at midfield in an NFL football field. The puddle of water forms a circular pattern around the sprinkler head with a radius in yards that grows as a function of time, in...

-

Based on Exhibit 77, what would be the monthly mortgage payments for each of the following situations? a. A $160,000,15-year loan at 6.5 percent. b. A $215,000, 30-year loan at 5 percent. c. A...

-

What is life insurance? What is its purpose?

-

What might be a savings goal for a person who buys a five-year CD paying 4.67 percent instead of an 18-month savings certificate paying 3.29 percent?

-

Cruz Manufacturing Ltds sales slumped badly in 2019. For the first time in its history, it operated at a loss. The companys income statement showed the following results from selling 600 000 units of...

-

The following are emails from various students to Dr. Destiny Sands, who is a professor in the English Department. These students are wondering if Dr. Sands would let them register for her...

-

What are some flawed assumptions about workplace communication? What is the reality for each myth?

Study smarter with the SolutionInn App