Question: } Janko Wellspring Inc. has a pump with a book value of $39,000 and a 4-year remaining life. A new, more efficient pump, is available

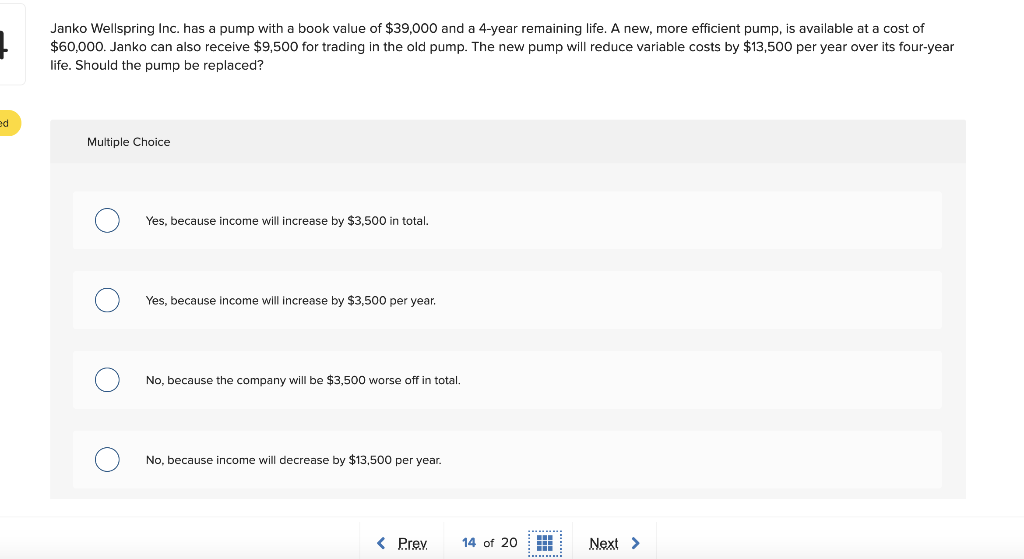

} Janko Wellspring Inc. has a pump with a book value of $39,000 and a 4-year remaining life. A new, more efficient pump, is available at a cost of $60,000. Janko can also receive $9,500 for trading in the old pump. The new pump will reduce variable costs by $13,500 per year over its four-year life. Should the pump be replaced? ed Multiple Choice Yes, because income will increase by $3,500 in total. Yes, because income will increase by $3,500 per year. No, because the company will be $3,500 worse off in total. O No, because income will decrease by $13,500 per year. Yes, because income will increase by $3,500 in total. O Yes, because income will increase by $3,500 per year. No, because the company will be $3,500 worse off in total. O No, because income will decrease by $13,500 per year. O O No, Janko will record loss of $19,000 if they replace the pump.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts