Question: January 2 9 , 2 0 2 4 Ms . Amy Westbrook 1 0 0 Tyler Lane Erie, PA 1 6 5 6 3 Dear

January

Ms Amy Westbrook

Tyler Lane

Erie, PA

Dear Amy:

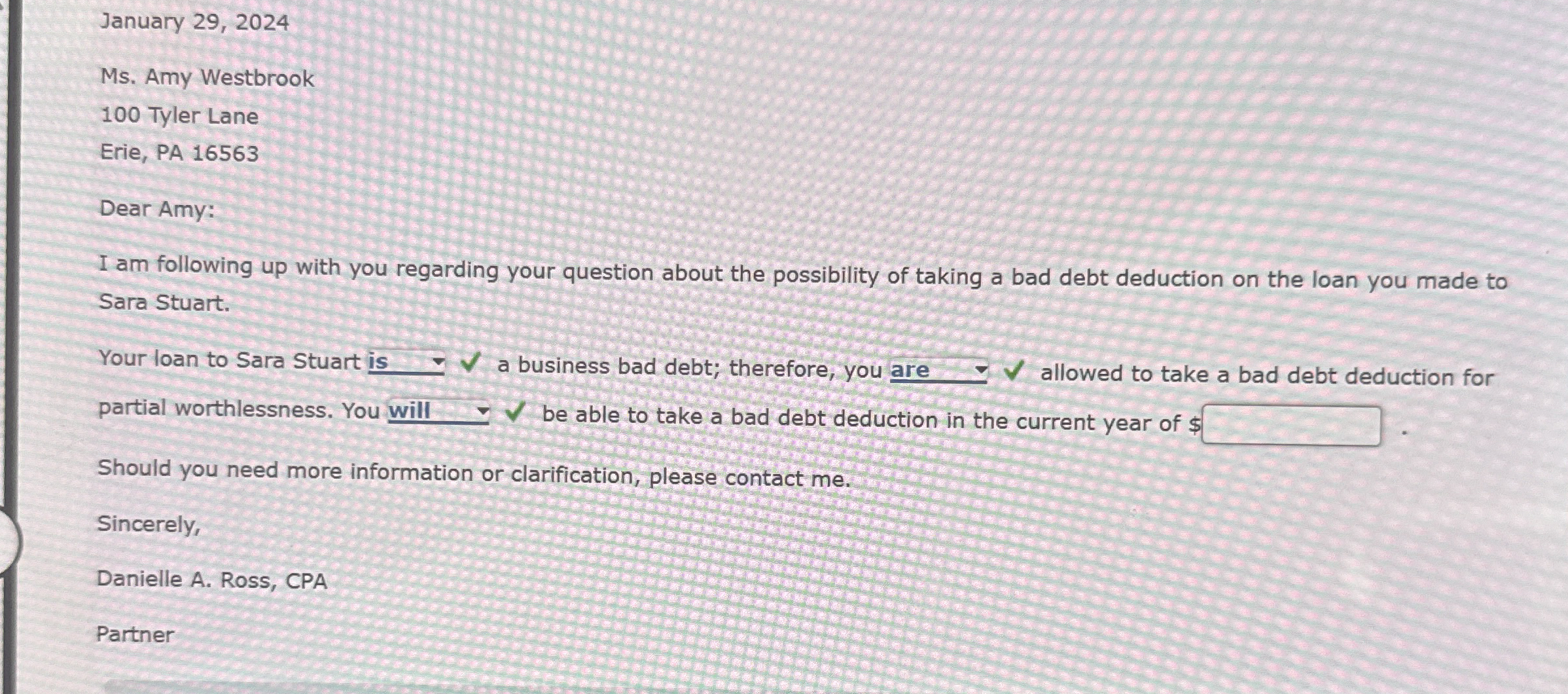

I am following up with you regarding your question about the possibility of taking a bad debt deduction on the loan you made to Sara Stuart.

Your loan to Sara Stuart a business bad debt; therefore, you are allowed to take a bad debt deduction for partial worthlessness. You be able to take a bad debt deduction in the current year of $

Should you need more information or clarification, please contact me

Sincerely,

Danielle A Ross, CPA

Partner

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock