Question: Jason Chow opened a doctor's practice on 1 March, 2019. On 31 March, the statement of financial position showed Cash $4,000, Accounts Receivable $1,500. Supplies

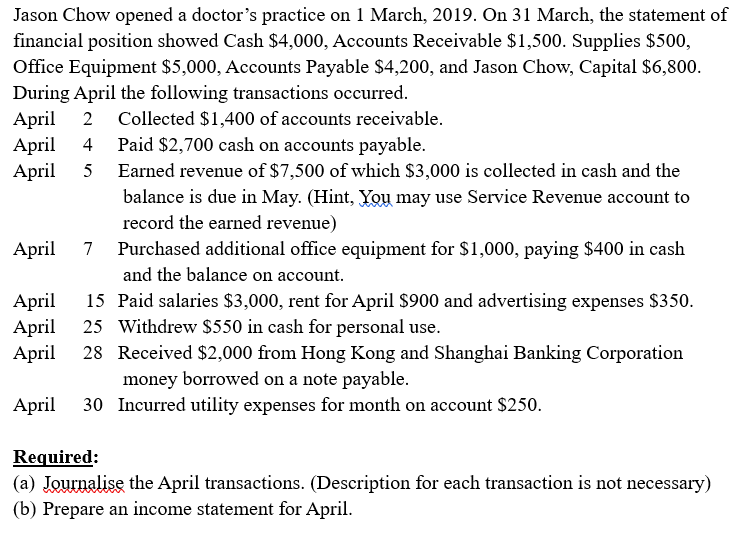

Jason Chow opened a doctor's practice on 1 March, 2019. On 31 March, the statement of financial position showed Cash $4,000, Accounts Receivable $1,500. Supplies $500, Office Equipment $5,000, Accounts Payable $4,200, and Jason Chow, Capital $6,800. During April the following transactions occurred. April 2 Collected $1,400 of accounts receivable. April 4 Paid $2,700 cash on accounts payable. April 5 Earned revenue of $7,500 of which $3,000 is collected in cash and the balance is due in May. (Hint, You may use Service Revenue account to record the earned revenue) April 7 Purchased additional office equipment for $1,000, paying $400 in cash and the balance on account. April 15 Paid salaries $3,000, rent for April $900 and advertising expenses $350. April 25 Withdrew $550 in cash for personal use. April 28 Received $2,000 from Hong Kong and Shanghai Banking Corporation money borrowed on a note payable. April 30 Incurred utility expenses for month on account $250. Required: (a) Journalise the April transactions. (Description for each transaction is not necessary) (b) Prepare an income statement for April

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts