Question: Jasper Junction Corporation (JJC) is an accrual basis, calendar-year entity that was created by Chao, Iris, and Nolan in 20X1. JJC furnishes the original incorporation

Jasper Junction Corporation (JJC) is an accrual basis, calendar-year entity that was created by Chao, Iris, and Nolan in 20X1. JJC furnishes the original incorporation agreement. The shareholders' bases in the assets contributed are as follows:

- Cash $150,000

- Equipment $245,000

- Inventory $380,000

- Land and Building $375,000

The first five years of business have been lean years. Nolan had to loan the corporation $75,000 to ensure that JJC had enough cash to pay its bills and its Accumulated Earnings and Profits only amounts to $23,000 at the end of 20X5. JJC has its first year of substantial income in 20X6. It also sells some of its land for $100,000 cash, but the sale results in a capital loss. The Board of Directors decides to pay $250,000 in dividends to its shareholders. This is in addition to the $3,500 of interest it pays on the bonds and the $1,500 it pays to Nolan on the money he loaned JJC. The income and expenses of JJC for 20X6, taxable income, and current E&P are provided in the Table below. Corporate Agreement

| Amount | Taxable Income | Current E&P | ||||

| Income | ||||||

| Taxable Income | 176,500 | |||||

| Sales | 412,000 | 412,000 | ||||

| COGS | 150,000 | (150,000 | ) | |||

| Dividends (own 5%) | 133,000 | 133,000 | ||||

| Muni Bond Interest | 1,000 | 1,000 | ||||

| Expenses | ||||||

| Capital loss | 32,935 | (32,935 | ) | |||

| Interest Expense | 5,000 | (5,000 | ) | |||

| Operating Expenses | 120,000 | (120,000 | ) | |||

| Key Life Insurance Premiums | 6,000 | - | (6,000 | ) | ||

| Taxable income before Special Deductions | 270,000 | |||||

| Charitable Contributions | 30,000 | (27,000 | ) | (3,000 | ) | |

| Dividend Receivable Deduction | (66,500 | ) | 66,500 | |||

| Taxable Income | 176,500 | |||||

| Federal Income Tax | 37,065 | (37,065 | ) | |||

| Current E&P | 165,000 | |||||

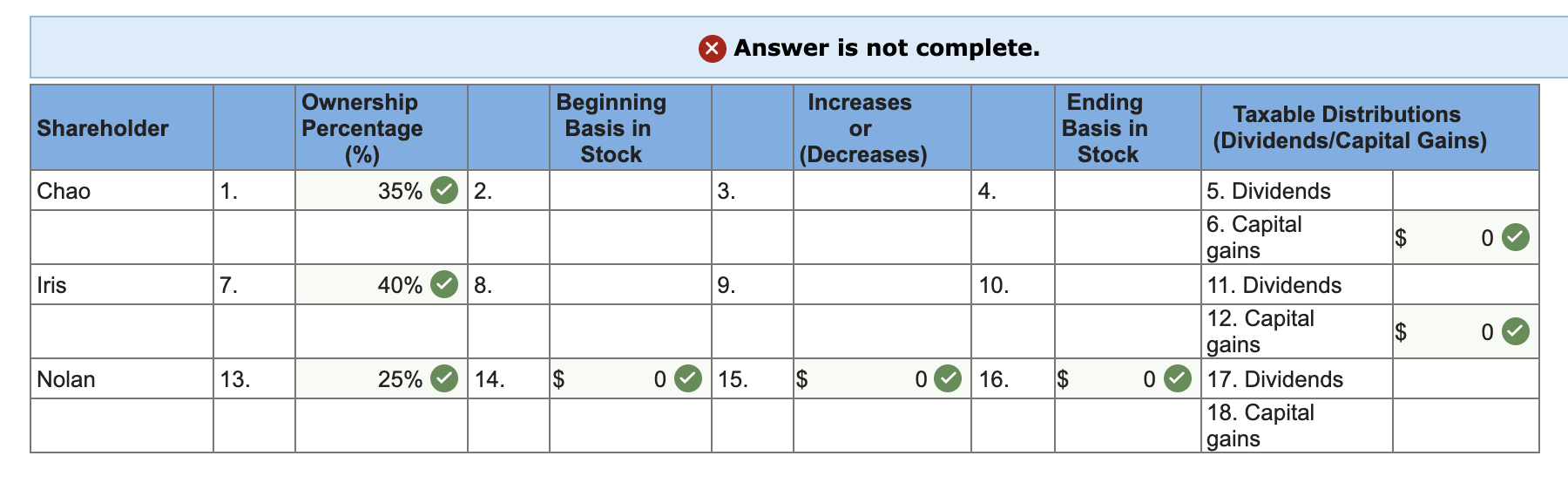

Analyze the information provided to reconcile the shareholders' beginning and ending bases in their stock to determine the federal tax consequences of JJC's corporate distributions. (Decreases should be entered with a minus sign.)

Answer is not complete. Shareholder Ownership Percentage (%) 35% Beginning Basis in Stock Increases or (Decreases) Ending Basis in Stock Taxable Distributions (Dividends/Capital Gains) Chao 1. 2. 3. 4. 0 Iris 7. 40% 8. 9. 10. 5. Dividends 6. Capital gains 11. Dividends 12. Capital gains 17. Dividends 18. Capital gains 0 Nolan 13. 25% 14. $ 0 O 15. $ 0 16. $ 0 Answer is not complete. Shareholder Ownership Percentage (%) 35% Beginning Basis in Stock Increases or (Decreases) Ending Basis in Stock Taxable Distributions (Dividends/Capital Gains) Chao 1. 2. 3. 4. 0 Iris 7. 40% 8. 9. 10. 5. Dividends 6. Capital gains 11. Dividends 12. Capital gains 17. Dividends 18. Capital gains 0 Nolan 13. 25% 14. $ 0 O 15. $ 0 16. $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts