Jax Incorporated reports the following data for its only product. The company had no beginning finished...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

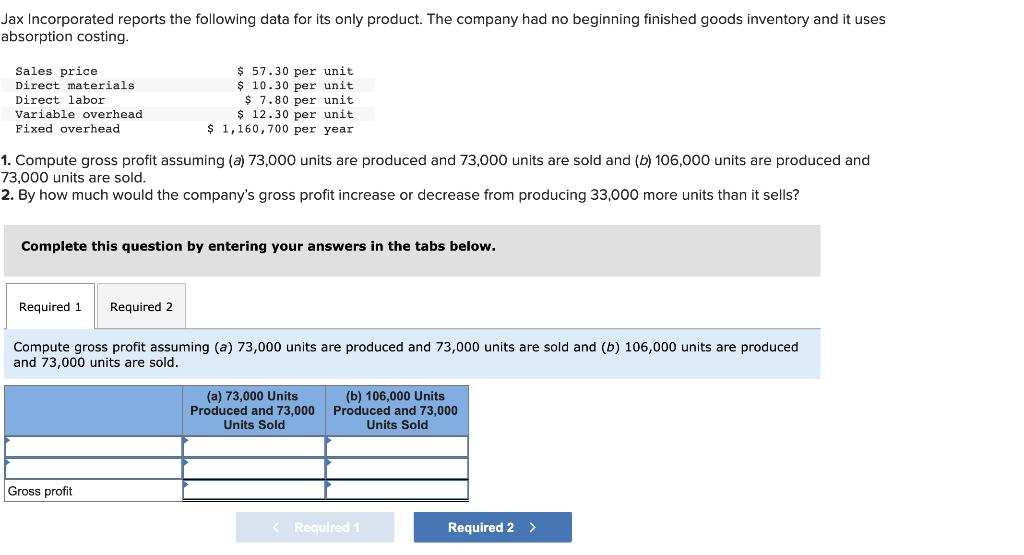

Jax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. $ 57.30 per unit $ 10.30 per unit $ 7.80 per unit $ 12.30 per unit $ 1,160,700 per year Sales price Direct materials Direct labor Variable overhead Fixed overhead 1. Compute gross profit assuming (a) 73,000 units are produced and 73,000 units are sold and (b) 106,000 units are produced and 73,000 units are sold. 2. By how much would the company's gross profit increase or decrease from producing 33,000 more units than it sells? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute gross profit assuming (a) 73,000 units are produced and 73,000 units are sold and (b) 106,000 units are produced and 73,000 units are sold. (a) 73,000 Units Produced and 73,000 Units Sold (b) 106,000 Units Produced and 73,000 Units Sold Gross profit < Required 1 Required 2 > Jax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. $ 57.30 per unit $ 10.30 per unit $ 7.80 per unit $ 12.30 per unit $ 1,160,700 per year Sales price Direct materials Direct labor Variable overhead Fixed overhead 1. Compute gross profit assuming (a) 73,000 units are produced and 73,000 units are sold and (b) 106,000 units are produced and 73,000 units are sold. 2. By how much would the company's gross profit increase or decrease from producing 33,000 more units than it sells? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute gross profit assuming (a) 73,000 units are produced and 73,000 units are sold and (b) 106,000 units are produced and 73,000 units are sold. (a) 73,000 Units Produced and 73,000 Units Sold (b) 106,000 Units Produced and 73,000 Units Sold Gross profit < Required 1 Required 2 >

Expert Answer:

Answer rating: 100% (QA)

Cost of Goods sold a 73000 units produced Details Units Rate Amount Direc... View the full answer

Related Book For

Financial Accounting

ISBN: 978-0324645576

10th edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice

Posted Date:

Students also viewed these accounting questions

-

The company reports the following data for the past three years Compute the allowance for bad debts as a percentage of accounts receivable and evaluate the quality of accounts receivable over the...

-

The Finishing Department reports the following data for the month: Equivalent Units of Production: Transferred In ............. 3,000 Direct Materials .......... 3,000 Conversion Costs ........ 2,250...

-

By how much would the 2008 tax rebates have shifted aggregate demand if the MPC was 0.95? (See the News Wire "Fiscal Stimulus: Tax Cuts.")

-

In Exercises 8194, begin by graphing the absolute value function, f(x) = |x| . Then use transformations of this graph to graph the given function. h(x) = x +31-2

-

Refer to the Spritz example of process costing in the chapter. Explain why the production costs for each department are added together to obtain an estimate of the cost per bottle of Spritz, yet the...

-

Why do investors pay more for a business than the statement of financial position value of the net assets?

-

The technique of Marginal Costing is based on classification of costs into ........ cost.

-

In water-resources engineering, the sizing or reservoirs depends on accurate estimates of water flow in the river that is being impounded. For some rivers, long-term historical records of such flow...

-

Middleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies. The firm has two offices-one in Toronto and one in Vancouver The firm...

-

ten-year-old Robby Johnson lives at 1234 Your Street in [Your City, Your State], with his parents Jane and Joe Johnson. In April of 2020, Jane and Joe hired Sam Jones, sole owner of Green Grass of...

-

Hi everyone please answer my question before Sunday Thank u Assignment no. 1 ACCT 302 Student name: Student ID: Total marks for each assignment: 10 marks Note: 10 marks of all 5 assignments (50...

-

3 Below is financial information for December Inc., which manufactures a single product: 4 5 5 7 3 #units produced October Low activity November High activity 7,000 11,000 Cost of goods manufactured...

-

(b) The satellite's booster rockets fire and lift the satellite to a higher circular orbit of radius 2R1. The satellite follows the path shown in the diagram below, moving a total distance S during...

-

D. An airplane flies at a speed of 250 kilometers per hour (kph) at an altitude of 3000 m. Assume the transition from laminar to turbulent boundary layers occurs at critical Reynolds Number, RE cr, =...

-

1. (35 points) by Qet = QoQ = Q0Q2 N!37 N/A (1-B, (r), where A- B(T) V * 4R (e-(R)/KT - 1) R dR is the second virial coefficient. The classical partition function for an imperfect gas comprising N...

-

es Farm has 28 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay 85,950.00 EI Premium Income Taxes...

-

3) The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Deductions: Sales salaries $625,000 Income tax withheld $232,260...

-

Write each fraction as a percent. 7 50

-

Refer to the data in PE 7-20. Compute number of days' sales in inventory. PE 7-20 Using the following data, compute inventory turnover. Inventory, December 31, year 1...

-

At the end of 2009, Spencer Systems, Inc., had a fire that destroyed the majority of its accounting records. Spencer Systems, Inc., was able to gather the following financial information for 2009. a....

-

The company had 300,000 shares of stock outstanding throughout the year. In addition, as of January 1 the company had issued stock options that allowed employees to receive 50,000 shares of stock for...

-

Are present channels of distribution reliable and cost effective?

-

Do marketing employees use appropriate marketing planning and controlling tools and techniques?

-

Are marketing planning and budgeting effective?

Study smarter with the SolutionInn App