Question: Jay, a partner with Burr & Co . , CPA's, is not independent with respect to the firm's client Bee & Bee & Cee is

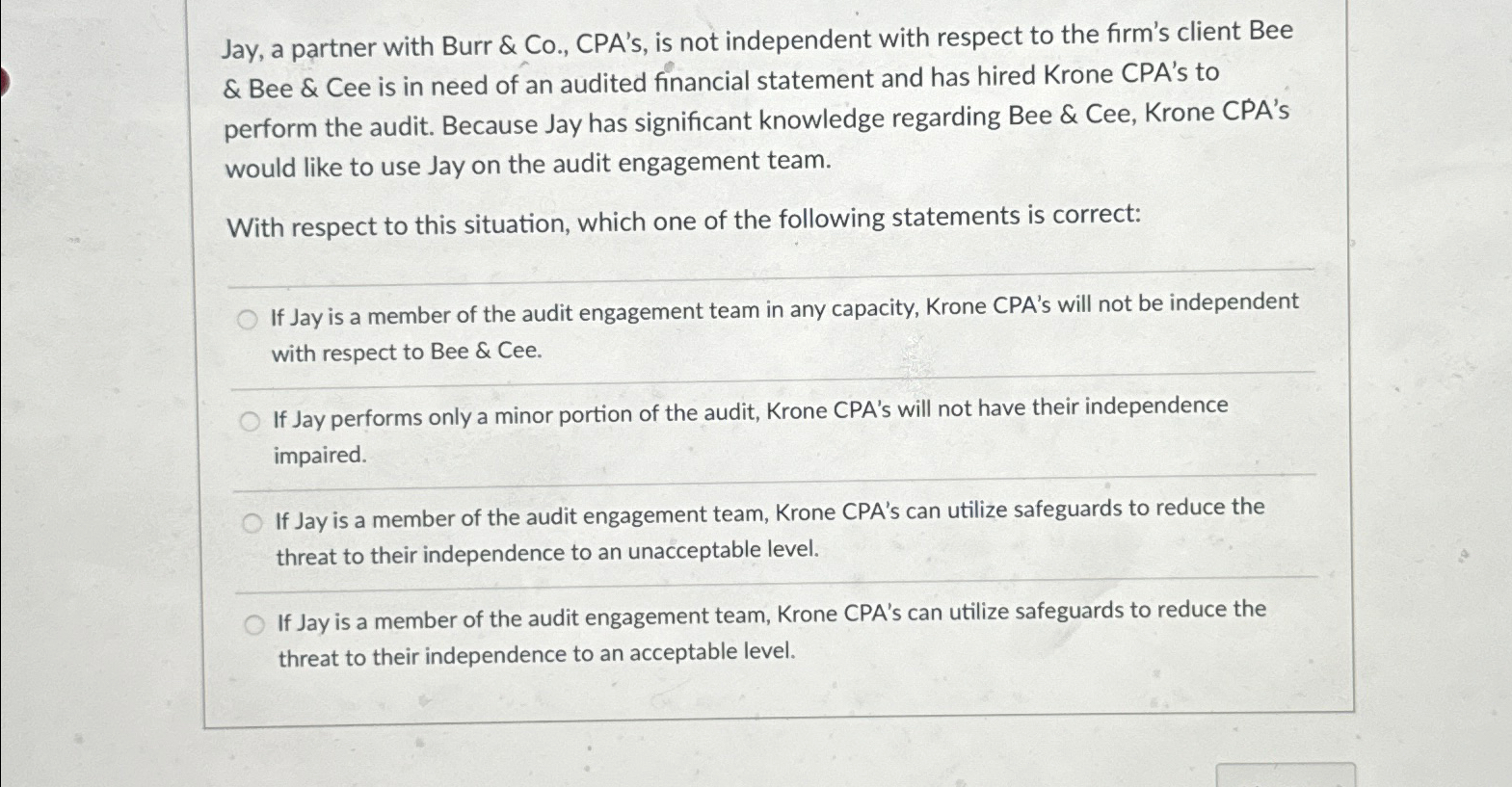

Jay, a partner with Burr & Co CPA's, is not independent with respect to the firm's client Bee & Bee & Cee is in need of an audited financial statement and has hired Krone CPA's to perform the audit. Because Jay has significant knowledge regarding Bee & Cee, Krone CPA's would like to use Jay on the audit engagement team.

With respect to this situation, which one of the following statements is correct:

If Jay is a member of the audit engagement team in any capacity, Krone CPA's will not be independent with respect to Bee & Cee.

If Jay performs only a minor portion of the audit, Krone CPA's will not have their independence impaired.

If Jay is a member of the audit engagement team, Krone CPA's can utilize safeguards to reduce the threat to their independence to an unacceptable level.

If Jay is a member of the audit engagement team, Krone CPA's can utilize safeguards to reduce the threat to their independence to an acceptable level.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock