Question: Jay and Kay are married, fle a joint return, and have two children (Debble and Arie). Debble is beginning her freshman year at 6 SU

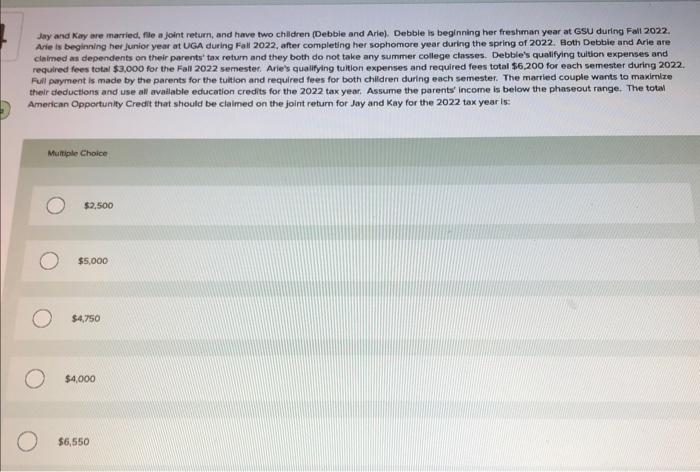

Jay and Kay are married, fle a joint return, and have two children (Debble and Arie). Debble is beginning her freshman year at 6 SU during Fali 2022. Arie is beginning her Junior year at UGA during Fall 2022, after completing her sophomore year during the spring of 2022 . Both Debbie and Arie are claimed as dependents on their parents' tax return and they both do not take any summer college classes. Debble's qualifying tuition expenses and required fees total $3,000 for the Fail 2022 semester. Arie's qualifying tuition expenses and required fees total $6,200 for each semester during 2022 . Full paryment is made by the parents for the fulion and required fees for both children during each semester. The married couple wants to maximize their deductions and use all available education credits for the 2022 tax year. Assume the parents' incorne is below the phaseout range. The total American Opportunity Credit that should be claimed on the joint return for Jay and Kay for the 2022 tax year is: Murtiple Ehoice $2,500 $5,000 54,750 $4,000 $6,550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts