Question: Jay's Comic Book Shop is interested in estimating its additional financing needs (AFN) to e support a rapid increase in sales next year. Last year

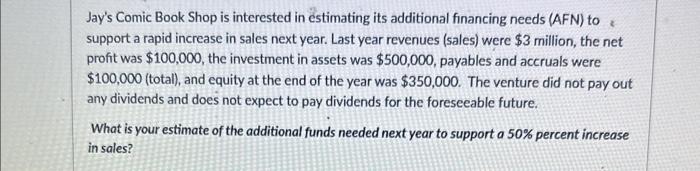

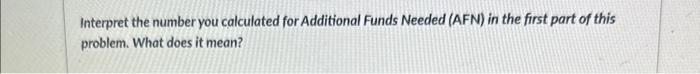

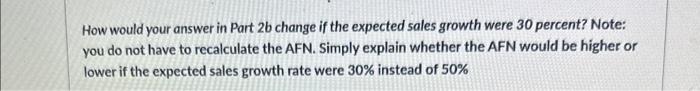

Jay's Comic Book Shop is interested in estimating its additional financing needs (AFN) to e support a rapid increase in sales next year. Last year revenues (sales) were $3 million, the net profit was $100,000, the investment in assets was $500,000, payables and accruals were $100,000 (total), and equity at the end of the year was $350,000. The venture did not pay out any dividends and does not expect to pay dividends for the foreseeable future. What is your estimate of the additional funds needed next year to support a 50% percent increase in sales? Interpret the number you calculated for Additional Funds Needed (AFN) in the first part of this problem. What does it mean? How would your answer in Part 2b change if the expected sales growth were 30 percent? Note: you do not have to recalculate the AFN. Simply explain whether the AFN would be higher or lower if the expected sales growth rate were 30% instead of 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts