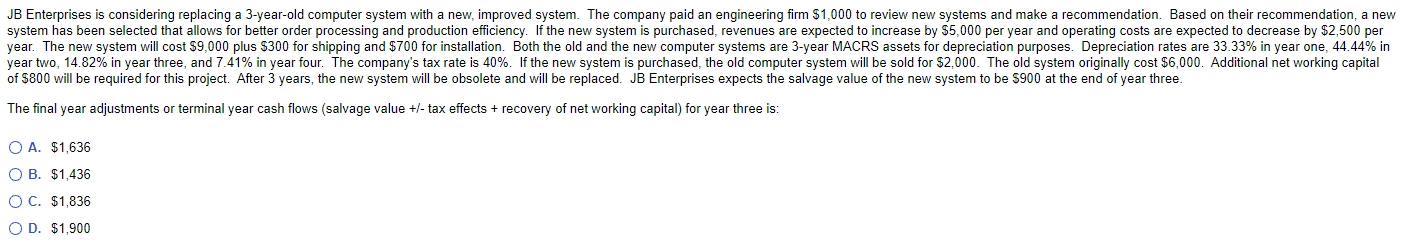

Question: JB Enterprises is considering replacing a 3 - year - old computer system with a new, improved system. The company paid an engineering firm $

JB Enterprises is considering replacing a yearold computer system with a new, improved system. The company paid an engineering firm $ to review new systems and make a recommendation. Based on their recommendation, a new

system has been selected that allows for better order processing and production efficiency. If the new system is purchased, revenues are expected to increase by $ per year and operating costs are expected to decrease by $ per

year. The new system will cost $ plus $ for shipping and $ for installation. Both the old and the new computer systems are year MACRS assets for depreciation purposes. Depreciation rates are in year one, in

year two, in year three, and in year four. The company's tax rate is If the new system is purchased, the old computer system will be sold for $ The old system originally cost $ Additional net working capital

of $ will be required for this project. After years, the new system will be obsolete and will be replaced. JB Enterprises expects the salvage value of the new system to be $ at the end of year three.

The final year adjustments or terminal year cash flows salvage value tax effects recovery of net working capital for year three is:

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock