Question: jdj Illustration 10 : E. Ltd. is considering the replacement of a machine used exclusively for the manufacture of one of its Product Y. The

jdj

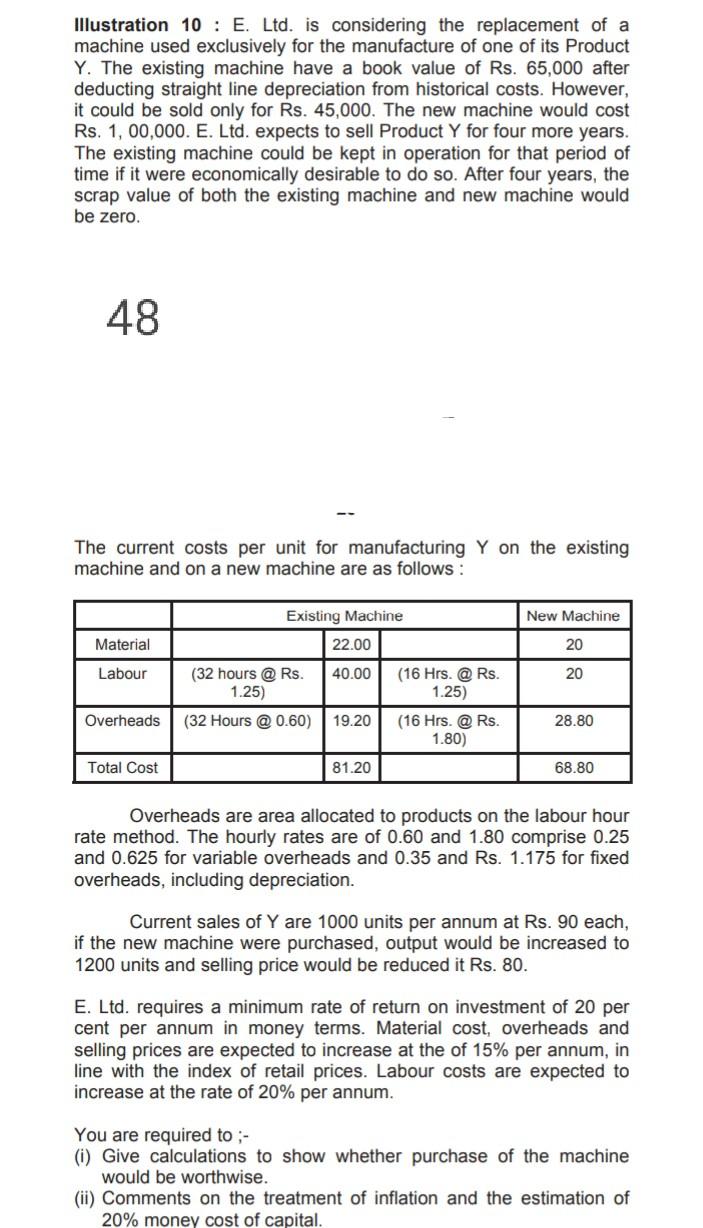

Illustration 10 : E. Ltd. is considering the replacement of a machine used exclusively for the manufacture of one of its Product Y. The existing machine have a book value of Rs. 65,000 after deducting straight line depreciation from historical costs. However, it could be sold only for Rs. 45,000. The new machine would cost Rs. 1,00,000. E. Ltd. expects to sell Product Y for four more years. The existing machine could be kept in operation for that period of time if it were economically desirable to do so. After four years, the scrap value of both the existing machine and new machine would be zero. 48 The current costs per unit for manufacturing Y on the existing machine and on a new machine are as follows: New Machine Existing Machine 22.00 Material 20 Labour 40.00 20 (32 hours @ Rs. 1.25) (32 Hours @ 0.60) (16 Hrs. @ Rs. 1.25) (16 Hrs. @ Rs. 1.80) Overheads 19.20 28.80 Total Cost 81.20 68.80 Overheads are area allocated to products on the labour hour rate method. The hourly rates are of 0.60 and 1.80 comprise 0.25 and 0.625 for variable overheads and 0.35 and Rs. 1.175 for fixed overheads, including depreciation. Current sales of Y are 1000 units per annum at Rs. 90 each, if the new machine were purchased, output would be increased to 1200 units and selling price would be reduced it Rs. 80. E. Ltd. requires a minimum rate of return on investment of 20 per cent per annum in money terms. Material cost, overheads and selling prices are expected to increase at the of 15% per annum, in line with the index of retail prices. Labour costs are expected to increase at the rate of 20% per annum. You are required to ;- (i) Give calculations to show whether purchase of the machine would be worthwise. (ii) Comments on the treatment of inflation and the estimation of 20% money cost of capital. Illustration 10 : E. Ltd. is considering the replacement of a machine used exclusively for the manufacture of one of its Product Y. The existing machine have a book value of Rs. 65,000 after deducting straight line depreciation from historical costs. However, it could be sold only for Rs. 45,000. The new machine would cost Rs. 1,00,000. E. Ltd. expects to sell Product Y for four more years. The existing machine could be kept in operation for that period of time if it were economically desirable to do so. After four years, the scrap value of both the existing machine and new machine would be zero. 48 The current costs per unit for manufacturing Y on the existing machine and on a new machine are as follows: New Machine Existing Machine 22.00 Material 20 Labour 40.00 20 (32 hours @ Rs. 1.25) (32 Hours @ 0.60) (16 Hrs. @ Rs. 1.25) (16 Hrs. @ Rs. 1.80) Overheads 19.20 28.80 Total Cost 81.20 68.80 Overheads are area allocated to products on the labour hour rate method. The hourly rates are of 0.60 and 1.80 comprise 0.25 and 0.625 for variable overheads and 0.35 and Rs. 1.175 for fixed overheads, including depreciation. Current sales of Y are 1000 units per annum at Rs. 90 each, if the new machine were purchased, output would be increased to 1200 units and selling price would be reduced it Rs. 80. E. Ltd. requires a minimum rate of return on investment of 20 per cent per annum in money terms. Material cost, overheads and selling prices are expected to increase at the of 15% per annum, in line with the index of retail prices. Labour costs are expected to increase at the rate of 20% per annum. You are required to ;- (i) Give calculations to show whether purchase of the machine would be worthwise. (ii) Comments on the treatment of inflation and the estimation of 20% money cost of capitalStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock