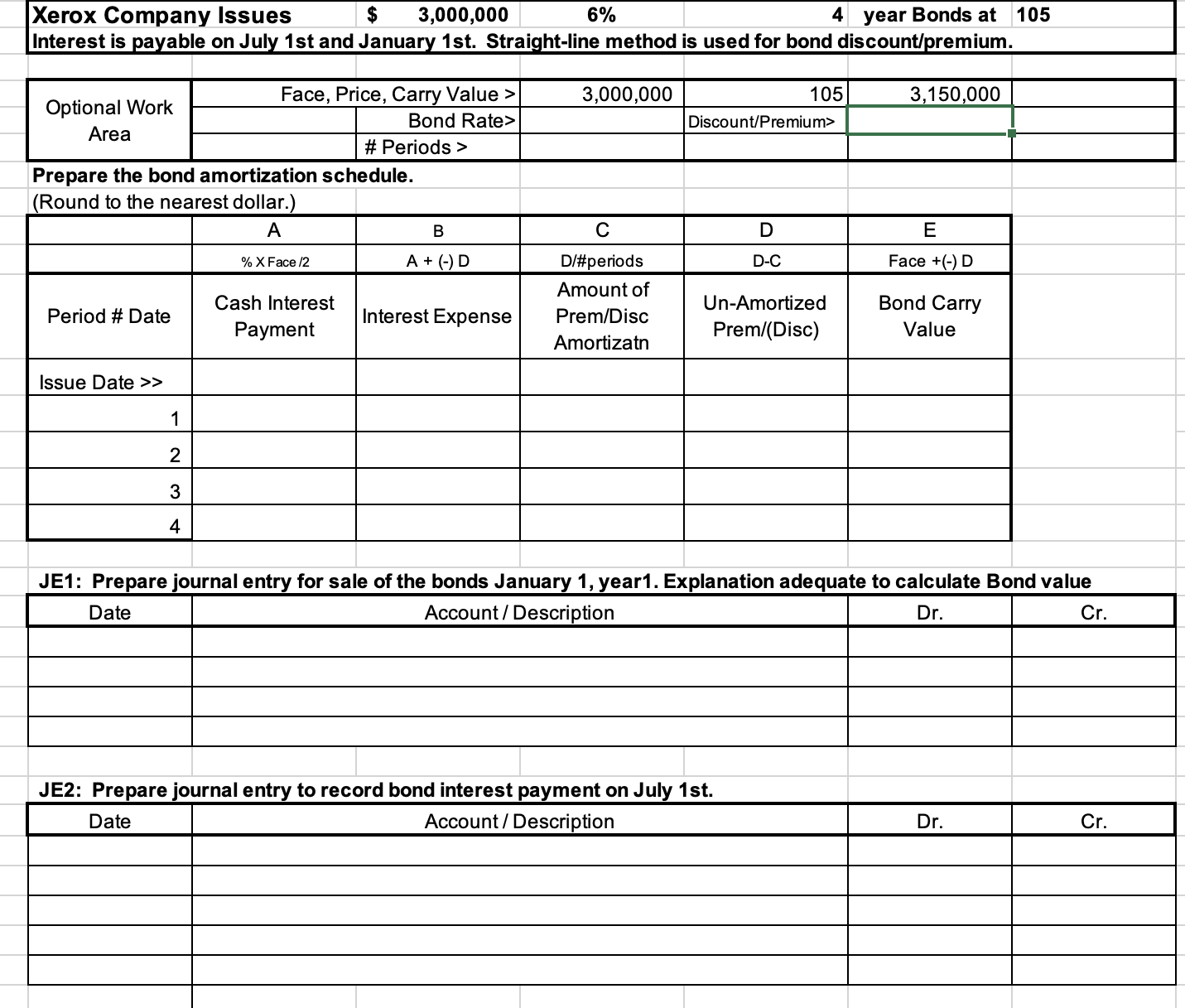

Question: JE 2 : Prepare journal entry to record bond interest payment on July 1 st . table [ [ Date , Account / Description,Dr

JE: Prepare journal entry to record bond interest payment on July st

tableDateAccount Description,DrCrJE: Prepare journal entry accrual of interest expense December stDateAccount Description,DrCr

JE: Prepare journal entry to pay interest January year

tableDateAccountDescriptionDrCr

Redeem Bonds @ on July st year # assuming Bond Interest payment has been made.

tableDateAccount Description,DrCrXerox Company Issues

$

year Bonds at

Interest is payable on July st and January st Straightline method is used for bond discountpremium

Prepare the bond amortization schedule.

Round to the nearest dollar.

JE: Prepare journal entry for sale of the bonds January year Explanation adequate to calculate Bond value

JE: Prepare journal entry to record bond interest payment on July st

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock