Question: Jefferson Products Inc. is considering purchasing a new automatic press brake, which costs $250,000 including installation and shipping. The machine is expected to generate

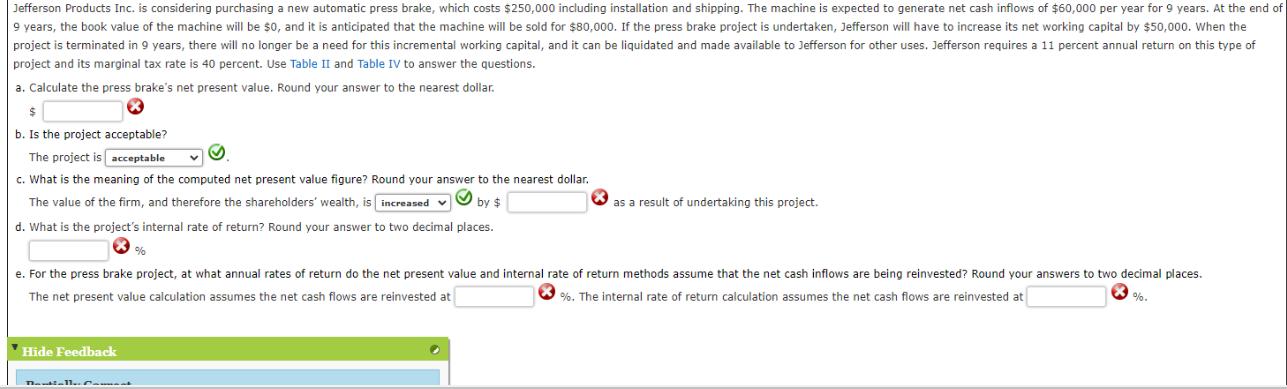

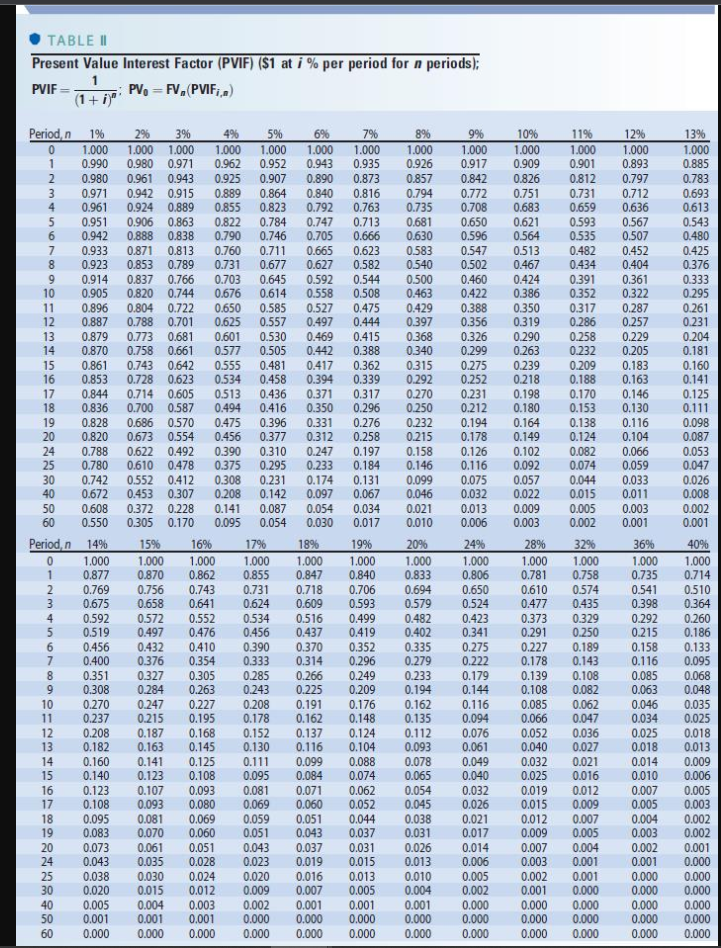

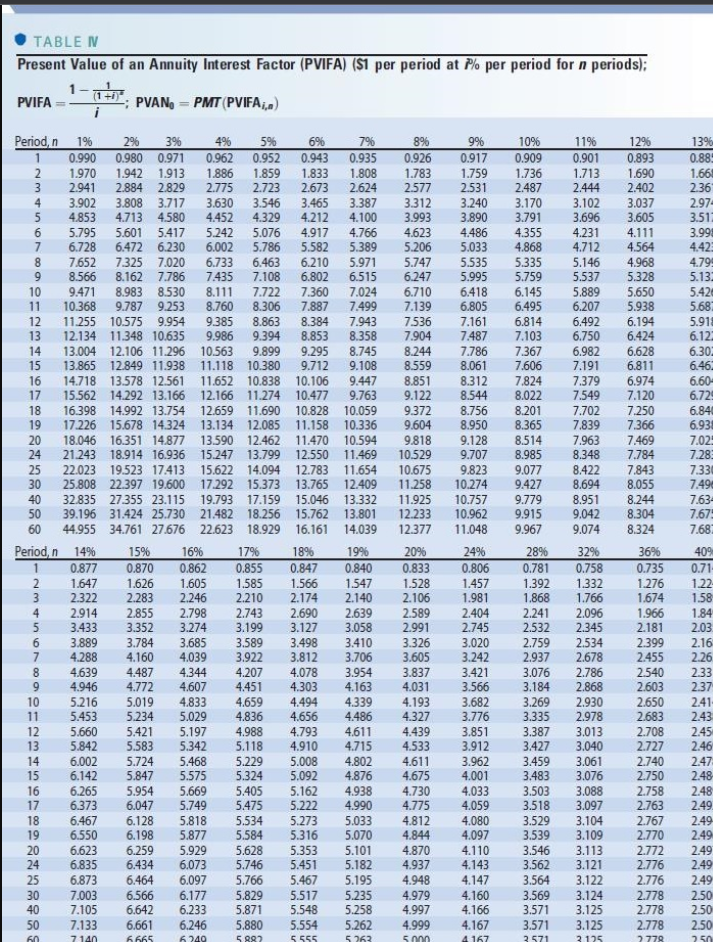

Jefferson Products Inc. is considering purchasing a new automatic press brake, which costs $250,000 including installation and shipping. The machine is expected to generate net cash inflows of $60,000 per year for 9 years. At the end of 9 years, the book value of the machine will be $0, and it is anticipated that the machine will be sold for $80,000. If the press brake project is undertaken, Jefferson will have to increase its net working capital by $50,000. When the project is terminated in 9 years, there will no longer be a need for this incremental working capital, and it can be liquidated and made available to Jefferson for other uses. Jefferson requires a 11 percent annual return on this type of project and its marginal tax rate is 40 percent. Use Table II and Table IV to answer the questions. a. Calculate the press brake's net present value. Round your answer to the nearest dollar. b. Is the project acceptable? The project is acceptable c. What is the meaning of the computed net present value figure? Round your answer to the nearest dollar. The value of the firm, and therefore the shareholders' wealth, is increased by $ as a result of undertaking this project. d. What is the project's internal rate of return? Round your answer to two decimal places. % e. For the press brake project, at what annual rates of return do the net present value and internal rate of return methods assume that the net cash inflows are being reinvested? Round your answers to two decimal places. The net present value calculation assumes the net cash flows are reinvested at %. The internal rate of return calculation assumes the net cash flows are reinvested at %. Hide Feedback newall Comment TABLE II Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); 1 PVIF === (1+i)" PV = FV, (PVIFi,n) Period, n 1% 2% 3% 4% 5% 6% 7% 9% 10% 11% 12% 13% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 4 0.961 0.924 0.889 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 6 0.942 0.888 0.838 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 19 0.828 0.686 0.570 0.475 0.396 0.331 0.276 0.232 0.194 0.164 0.138 0.116 0.098 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 0.002 60 0.550 0.305 0.170 0.095 0.054 0.030 0.017 0.010 0.006 0.003 0.002 0.001 0.001 Period, n 14% 15% 16% 17% 18% 19% 20% 24% 28% 32% 36% 40% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.806 0.781 0.758 0.735 0.714 2345 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.650 0.610 0.574 0.541 0.510 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.524 0.477 0.435 0.398 0.364 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.423 0.373 0.329 0.292 0.260 5 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.341 0.291 0.250 0.215 0.186 6 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.275 0.227 0.189 0.158 0.133 7 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.222 0.178 0.143 0.116 0.095 8 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.179 0.139 0.108 0.085 0.068 9 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.144 0.108 0.082 0.063 0.048 10 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.116 0.085 0.062 0.046 0.035 11 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.094 0.066 0.047 0.034 0.025 12 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.076 0.052 0.036 0.025 0.018 13 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.061 0.040 0.027 0.018 0.013 14 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.049 0.032 0.021 0.014 0.009 15 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.040 0.025 0.016 0.010 0.006 16 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.032 0.019 0.012 0.007 0.005 TRAALE24 17 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.026 0.015 0.009 0.005 0.003 18 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.021 0.012 0.007 0.004 0.002 19 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.017 0.009 0.005 0.003 0.002 20 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.014 0.007 0.004 0.002 0.001 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.006 0.003 0.001 0.001 0.000 25 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.005 0.002 0.001 0.000 0.000 30 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.002 0.001 0.000 0.000 0.000 40 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 50 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 TABLE IV Present Value of an Annuity Interest Factor (PVIFA) ($1 per period at 7% per period for n periods); PVAN PMT (PVIFA,,n) = PVIFA == Period, n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 2345 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.66 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.97- 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.512 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.231 4.111 3.99 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.795 10 90 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 7.379 6.974 6.60 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 222242 20 18.046 16.351 14.877 13.590 21.243 18.914 16.936 15.247 25 22.023 19.523 17.413 15.622 12.462 11.470 10.594 9.818 9.128 8.514 7.963 7.469 7.02 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 7.283 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 30 25.808 22.397 19.600 17.292 15.373 40 32.835 27.355 23.115 19.793 17.159 15.046 50 39.196 31.424 25.730 21.482 18.256 60 44.955 34.761 27.676 22.623 18.929 16.161 14.039 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.49 13.332 11.925 10.757 9.779 8.951 8.244 7.634 15.762 13.801 12.233 10.962 9.915 9.042 8.304 7.675 12.377 11.048 9.967 9.074 8.324 7.687 Period, n 14% 15% 16% 17% 18% 19% 20% 24% 28% 32% 36% 40% 10 11 -2345698901 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.806 0.781 0.758 0.735 0.71 2 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.457 1.392 1.332 1.276 1.22 3 2.322 2.283 2.246 2.210 2.174 2.140 2.106 1.981 1.868 1.766 1.674 1.58 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.404 2.241 2.096 1.966 1.84 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.745 2.532 2.345 2.181 2.03. 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.020 2.759 2.534 2.399 2.16 7 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.242 2.937 2.678 2.455 2.26 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.421 3.076 2.786 2.540 2.33 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.566 3.184 2.868 2.603 2.37 5.216 5.019 4.833 4.659 4.494 4.339 4.193 3.682 3.269 2.930 2.650 2.41- 5.453 5.234 5.029 4.836 4.656 4.486 4.327 3.776 3.335 2.978 2.683 2.43 12 13 14 15 2345. 5.660 5.421 5.197 4.988 4.793 4.611 4.439 3.851 3.387 3.013 2.708 2.45 5.842 5.583 5.342 5.118 4.910 4.715 4.533 3.912 3.427 3.040 2.727 2.460 6.002 5.724 5.468 5.229 5.008 4.802 4.611 3.962 3.459 3.061 2.740 2.47 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.001 3.483 3.076 2.750 2.48 16 6.265 5.954 5.669 5.405 5.162 4.938 4.730 4.033 3.503 3.088 2.758 2.48 17 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.059 3.518 3.097 2.763 2.49. 18 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.080 3.529 3.104 2.767 2.49 19 6.550 20 6.623 6.198 6.259 5.929 5.877 5.584 5.316 5.070 4.844 4.097 3.539 3.109 2.770 2.49 5.628 5.353 5.101 4.870 4.110 3.546 3.113 2.772 2.497 24 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.143 3.562 3.121 2.776 2.49 25 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.147 30 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.160 3.564 3.122 3.569 3.124 2.776 2.49 2.778 2.50 40 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.166 3.571 3.125 2.778 2.50 50 7.133 6.661 6.246 5.880 5.554 5.262 4.999 4.167 3.571 3.125 2.778 2.50 60 7140 6.665 6249 5882 5.555 5.263 5.000 4167 3571 3125 2778 250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts