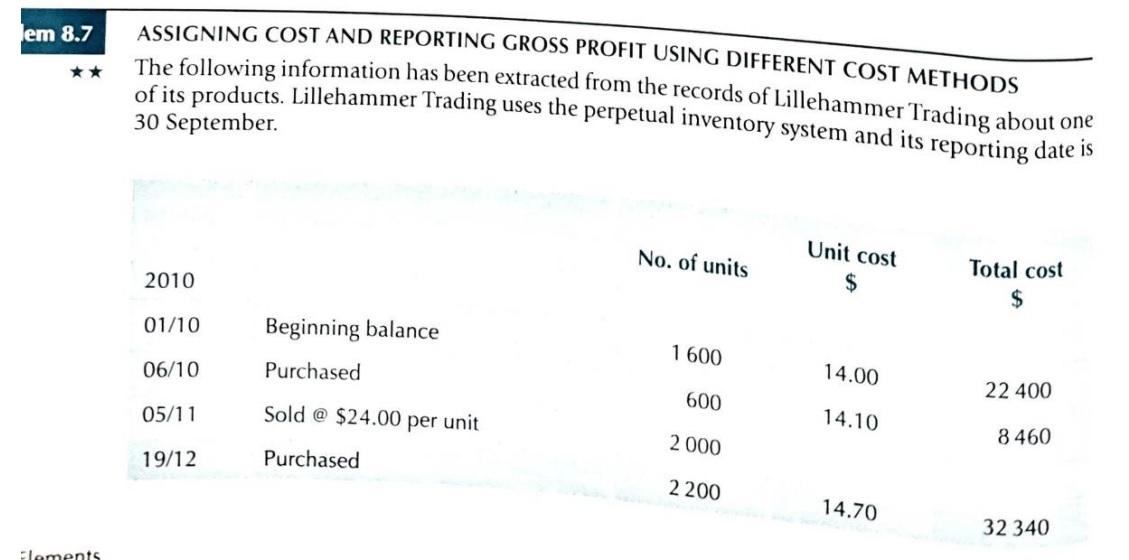

Question: Jem 8.7 ASSIGNING COST AND REPORTING GROSS PROFIT USING DIFFERENT COST METHODS The following information has been extracted from the records of Lillehammer Trading about

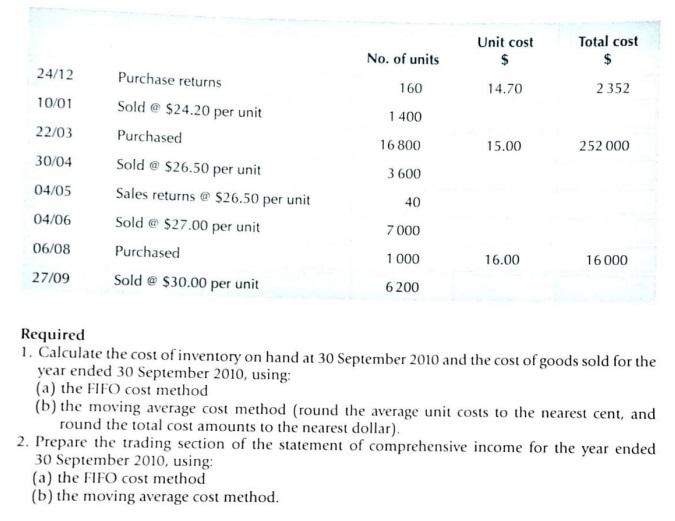

Jem 8.7 ASSIGNING COST AND REPORTING GROSS PROFIT USING DIFFERENT COST METHODS The following information has been extracted from the records of Lillehammer Trading about one of its products. Lillehammer Trading uses the perpetual inventory system and its reporting date is 30 September No. of units Unit cost 2010 $ Total cost $ 01/10 Beginning balance 1600 06/10 Purchased 14.00 600 22 400 05/11 Sold @ $24.00 per unit 14.10 2 000 8 460 19/12 Purchased 2200 14.70 32 340 Flaments Unit cost $ 14.70 Total cost $ No. of units 24/12 2352 10/01 22/03 160 1 400 16 800 3600 15.00 252 000 Purchase returns Sold @ $24.20 per unit Purchased Sold @ $26.50 per unit Sales returns @ $26.50 per unit Sold @ $27.00 per unit Purchased Sold @ $30.00 per unit 30/04 04/05 40 04/06 06/08 7000 1 000 6200 16.00 16000 27/09 Required 1. Calculate the cost of inventory on hand at 30 September 2010 and the cost of goods sold for the year ended 30 September 2010, using: (a) the FIFO cost method (b) the moving average cost method (round the average unit costs to the nearest cent, and round the total cost amounts to the nearest dollar) 2. Prepare the trading section of the statement of comprehensive income for the year ended 30 September 2010, using: (a) the FIFO cost method (b) the moving average cost method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts