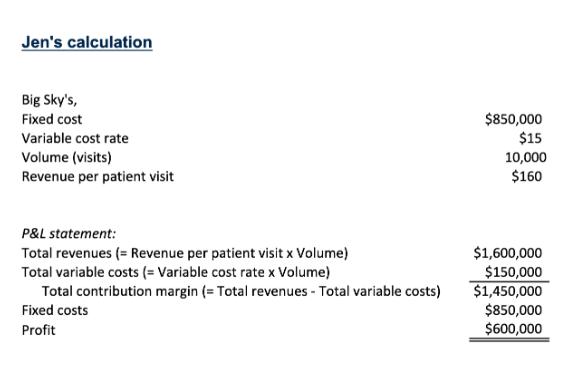

Question: Jen's calculation Big Sky's, Fixed cost Variable cost rate Volume (visits) Revenue per patient visit P&L statement: Total revenues (= Revenue per patient visit

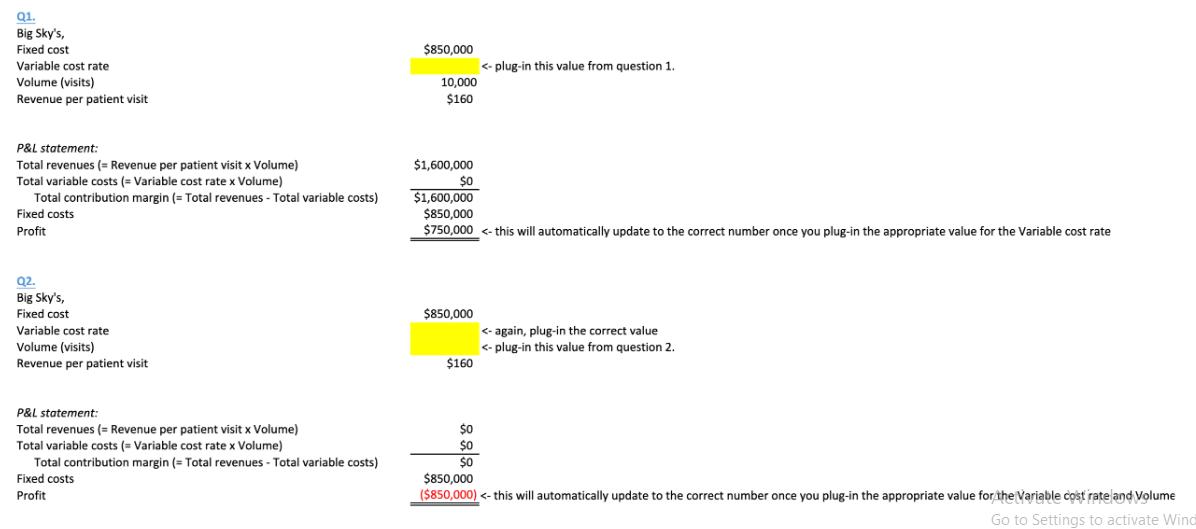

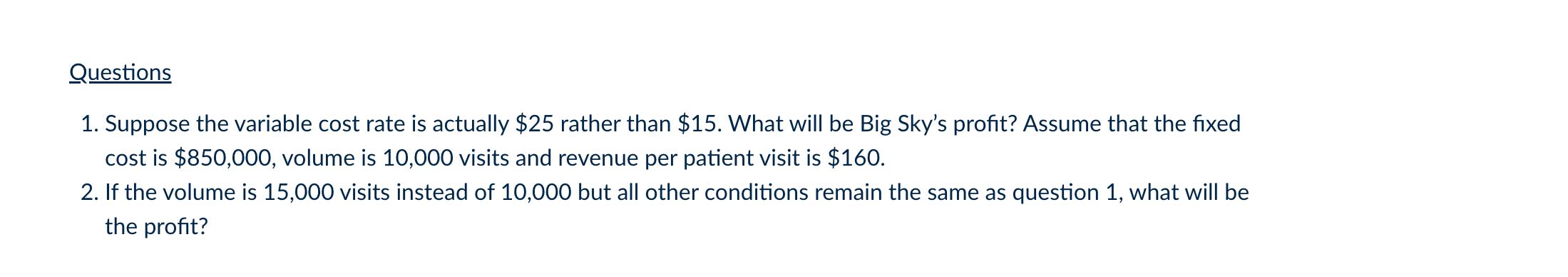

Jen's calculation Big Sky's, Fixed cost Variable cost rate Volume (visits) Revenue per patient visit P&L statement: Total revenues (= Revenue per patient visit x Volume) Total variable costs (= Variable cost rate x Volume) Total contribution margin (= Total revenues - Total variable costs) Fixed costs Profit $850,000 $15 10,000 $160 $1,600,000 $150,000 $1,450,000 $850,000 $600,000 Q1. Big Sky's, Fixed cost Variable cost rate Volume (visits) Revenue per patient visit P&L statement: Total revenues (= Revenue per patient visit x Volume) Total variable costs (= Variable cost rate x Volume) Total contribution margin (= Total revenues - Total variable costs) Fixed costs Profit Q2. Big Sky's, Fixed cost Variable cost rate. Volume (visits) Revenue per patient visit P&L statement: Total revenues (= Revenue per patient visit x Volume) Total variable costs (= Variable cost rate x Volume) Total contribution margin (= Total revenues - Total variable costs) Fixed costs Profit $850,000 10,000 $160 $1,600,000 $0 $1,600,000 $850,000 $750,000 Questions 1. Suppose the variable cost rate is actually $25 rather than $15. What will be Big Sky's profit? Assume that the fixed cost is $850,000, volume is 10,000 visits and revenue per patient visit is $160. 2. If the volume is 15,000 visits instead of 10,000 but all other conditions remain the same as question 1, what will be the profit?

Step by Step Solution

There are 3 Steps involved in it

1 To calculate Big Skys profit when the variable cost rate is 25 Fixed cost 850000 Volume visits 100... View full answer

Get step-by-step solutions from verified subject matter experts