Question: Jensen's based on the CAPM does not capture the performance of various stock characteristics benchmarks (such as size, value and momentum). One way to correct

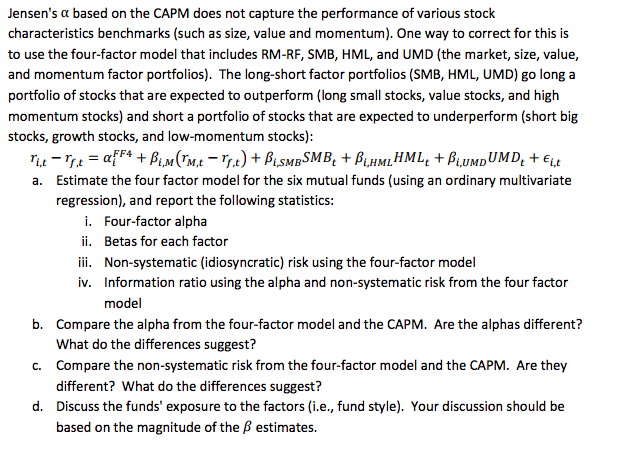

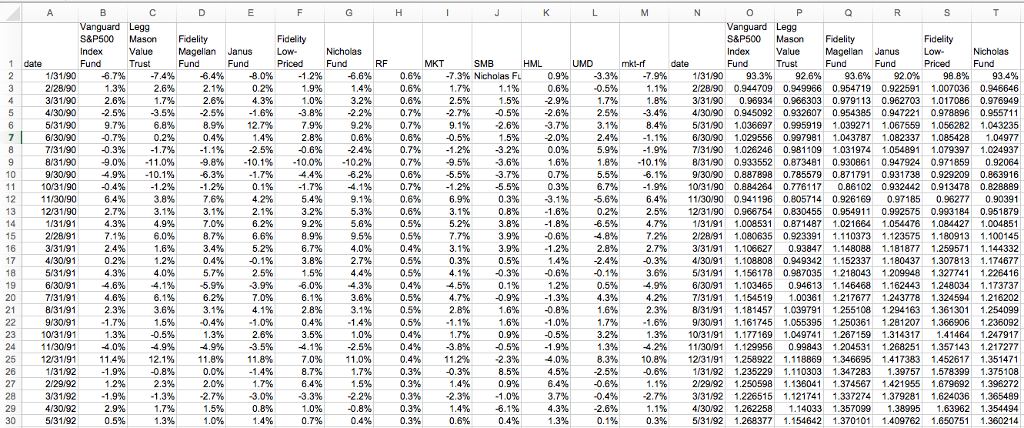

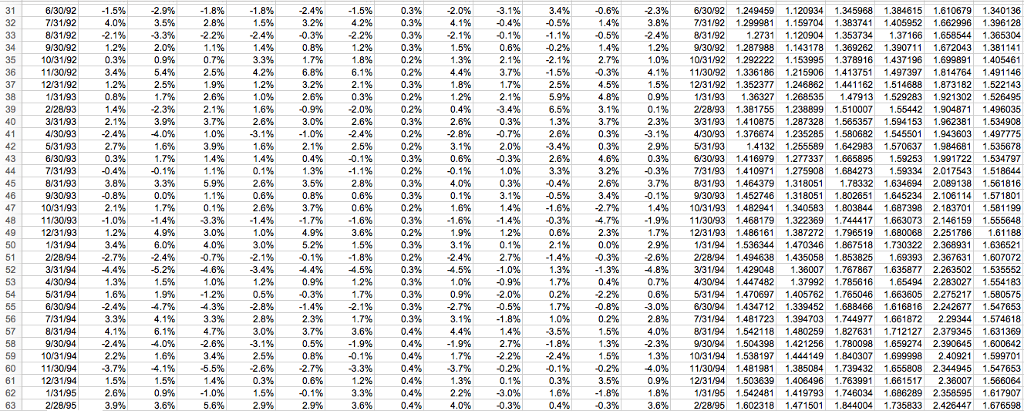

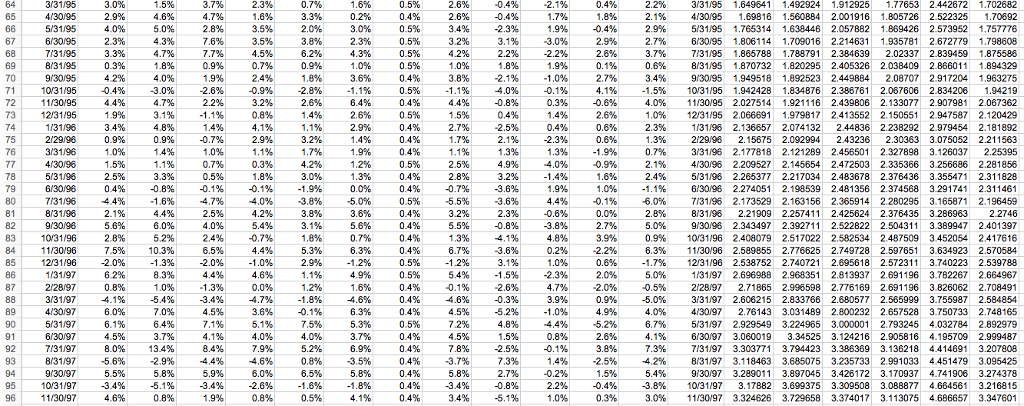

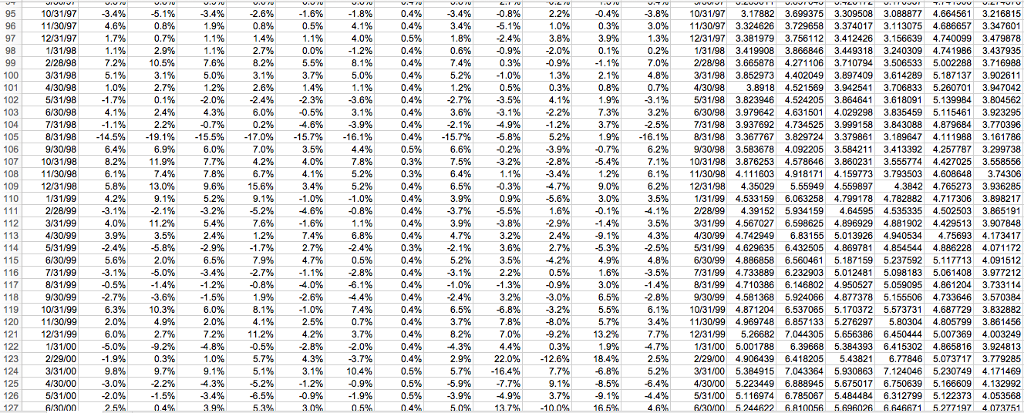

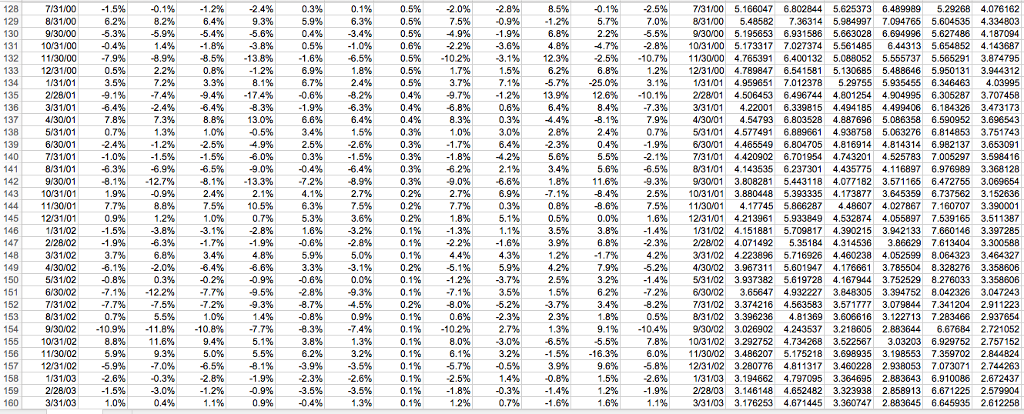

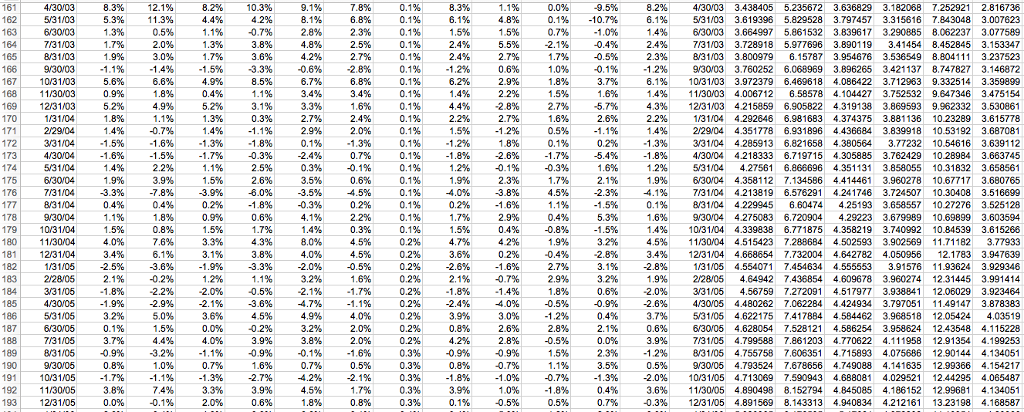

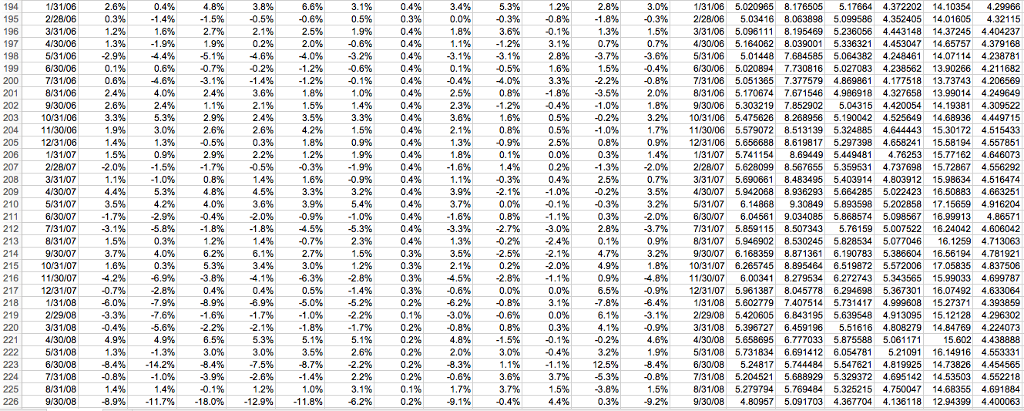

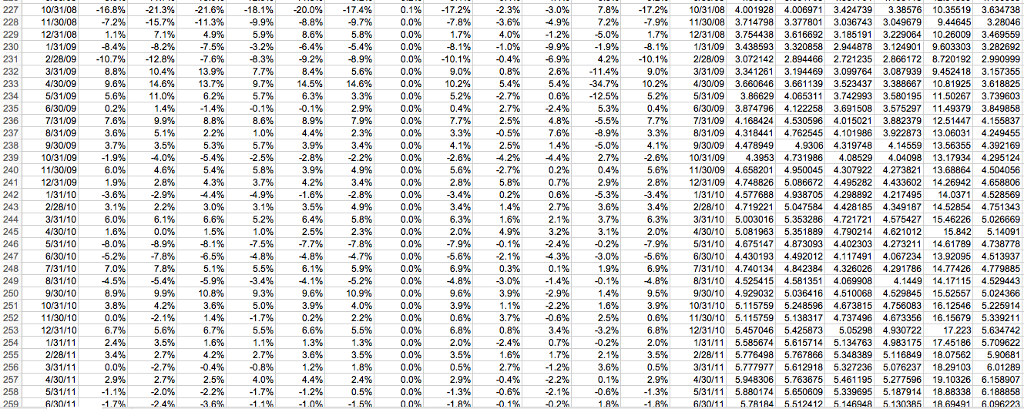

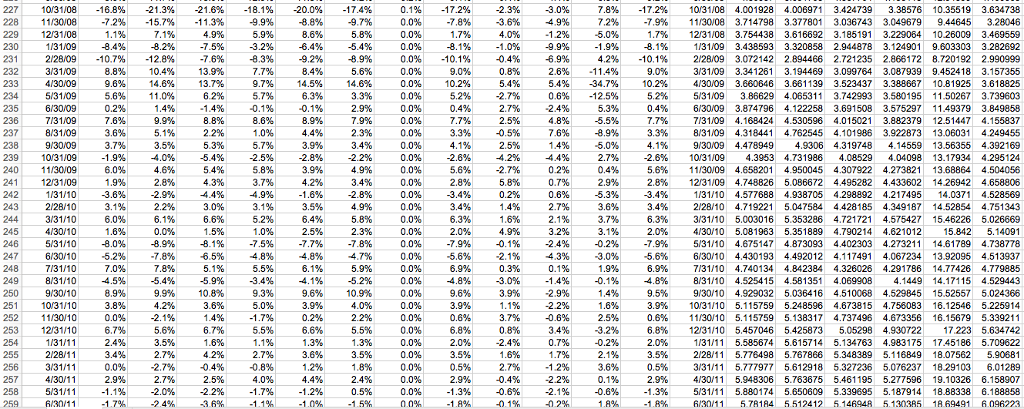

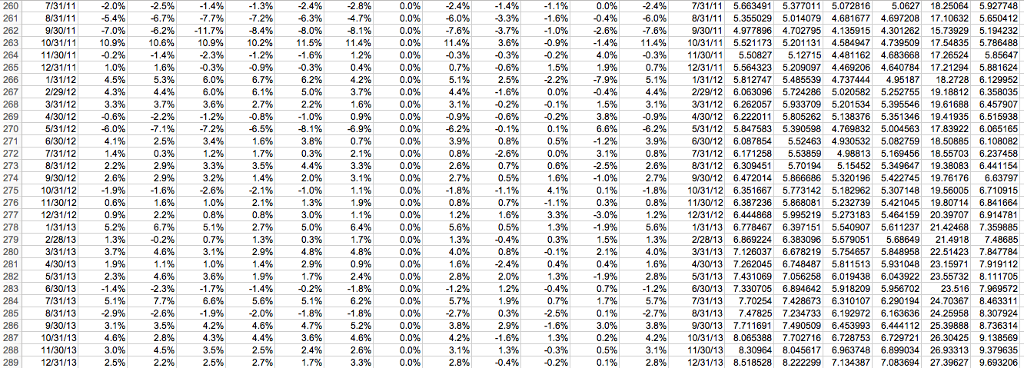

Jensen's based on the CAPM does not capture the performance of various stock characteristics benchmarks (such as size, value and momentum). One way to correct for this is to use the four-factor model that includes RM-RF, SMB, HML, and UMD (the market, size, value, and momentum factor portfolios). The long-short factor portfolios (SMB, HML, UMD) go long a portfolio of stocks that are expected to outperform (long small stocks, value stocks, and high momentum stocks) and short a portfolio of stocks that are expected to underperform (short big stocks, growth stocks, and low-momentum stocks): FF4 MB t T Pi.UMDUMD Estimate the four factor model for the six mutual funds (using an ordinary multivariate regression), and report the following statistics: a. i. Four-factor alpha ii. ii. Non-systematic (idiosyncratic) risk using the four-factor model iv. Betas for each factor Information ratio using the alpha and non-systematic risk from the four factor model b. Compare the alpha from the four-factor model and the CAPM. Are the alphas different? What do the differences suggest? Compare the non-systematic risk from the four-factor model and the CAPM. Are they different? What do the differences suggest? Discuss the funds' exposure to the factors (i.e., fund style). Your discussion should be based on the magnitude of the estimates. c. d. Jensen's based on the CAPM does not capture the performance of various stock characteristics benchmarks (such as size, value and momentum). One way to correct for this is to use the four-factor model that includes RM-RF, SMB, HML, and UMD (the market, size, value, and momentum factor portfolios). The long-short factor portfolios (SMB, HML, UMD) go long a portfolio of stocks that are expected to outperform (long small stocks, value stocks, and high momentum stocks) and short a portfolio of stocks that are expected to underperform (short big stocks, growth stocks, and low-momentum stocks): FF4 MB t T Pi.UMDUMD Estimate the four factor model for the six mutual funds (using an ordinary multivariate regression), and report the following statistics: a. i. Four-factor alpha ii. ii. Non-systematic (idiosyncratic) risk using the four-factor model iv. Betas for each factor Information ratio using the alpha and non-systematic risk from the four factor model b. Compare the alpha from the four-factor model and the CAPM. Are the alphas different? What do the differences suggest? Compare the non-systematic risk from the four-factor model and the CAPM. Are they different? What do the differences suggest? Discuss the funds' exposure to the factors (i.e., fund style). Your discussion should be based on the magnitude of the estimates. c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts