Question: Jerome, Inc., owned a single short-term available-for-sale security with a cost of $40,000 and a fair value of $40,500 at December 31 of the

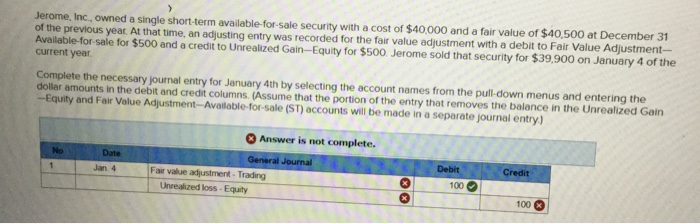

Jerome, Inc., owned a single short-term available-for-sale security with a cost of $40,000 and a fair value of $40,500 at December 31 of the previous year. At that time, an adjusting entry was recorded for the fair value adjustment with a debit to Fair Value Adjustment- Available for sale for $500 and a credit to Unrealized Gain-Equity for $500. Jerome sold that security for $39,900 on January 4 of the current year. Complete the necessary journal entry for January 4th by selecting the account names from the pull-down menus and entering the dollar amounts in the debit and credit columns. (Assume that the portion of the entry that removes the balance in the Unrealized Gain -Equity and Fair Value Adjustment-Available-for-sale (ST) accounts will be made in a separate journal entry.) No 1 Date Jan 4 Answer is not complete. General Journal Fair value adjustment - Trading Unrealized loss-Equity XX Debit 100 Credit 100 x

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

To complete the necessary journal entries for January 4th for Jerome Inc lets follow these steps Bac... View full answer

Get step-by-step solutions from verified subject matter experts