Question: Jillian Murphy has been given the task to do a DCF valuation for her company. She has been given the following projected numbers for

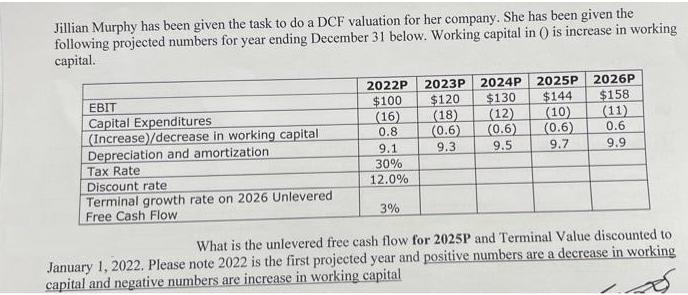

Jillian Murphy has been given the task to do a DCF valuation for her company. She has been given the following projected numbers for year ending December 31 below. Working capital in () is increase in working capital. EBIT Capital Expenditures (Increase)/decrease in working capital Depreciation and amortization Tax Rate Discount rate Terminal growth rate on 2026 Unlevered Free Cash Flow 2022P 2023P 2024P 2025P $100 $120 $130 $144 (16) (18) (12) (10) (0.6) (0.6) 0.8 (0.6) 9.3 9.5 9.7 9.1 30% 12.0% 3% 2026P $158 (11) 0.6 9.9 What is the unlevered free cash flow for 2025P and Terminal Value discounted to January 1, 2022. Please note 2022 is the first projected year and positive numbers are a decrease in working capital and negative numbers are increase in working capital

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Earnings before interest and Tax EBIT 2025P 144 Taxes 2025P EBIT 2025 P Tax Rate 2022 P 144 ... View full answer

Get step-by-step solutions from verified subject matter experts