Question: Jim just got a coding job so he will need a new laptop. He finds a good one, which costs $20,000 and can be used

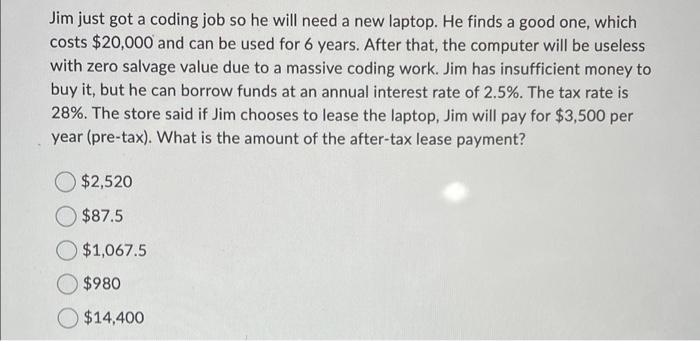

Jim just got a coding job so he will need a new laptop. He finds a good one, which costs $20,000 and can be used for 6 years. After that, the computer will be useless with zero salvage value due to a massive coding work. Jim has insufficient money to buy it, but he can borrow funds at an annual interest rate of 2.5%. The tax rate is 28%. The store said if Jim chooses to lease the laptop, Jim will pay for $3,500 per year (pre-tax). What is the amount of the after-tax lease payment? $2,520 $87.5 $1,067.5 $980 $14,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts