Question: Jim Markowta is envolled in a pressious MBA program and participanes in a siludert imewament fund competion. A total investment amount of $ 1 5

Jim Markowta is envolled in a pressious MBA program and participanes in a siludert imewament fund competion. A total investment amount of $ is allocated io his portfolia, and he has thee inverbere costons to choose from. The expected refums from the minimum refurn of but to increase his chance of advancing to the sacond round. Jimeneds so minimae that liveltament rikk of his portolia. He uses the following formula to estimate his portfolloy rate

here and are the proportion of his investment amount as an intial value for and

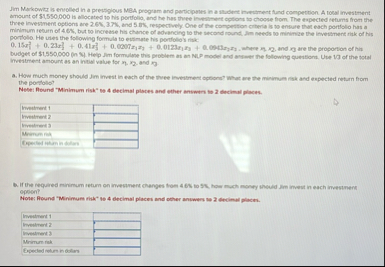

a How much money should Jim invest in each of the three investment opsons? what are the minimum rak and expected return from the portfollo?

Nebel Bound "Minimum risk" se decimal places and sther answers to descreal pheres.

tableInvatrent Investrent Livedtress Mersm ral,Experted mban in ablers,

b If the required minimum retum on imesomert changes from to how much money shoud Jim inveut in each imestmert epsion?

Note: Round "Minimum risk" te decimal places and other answers sas decimal places.

tableInvestment Fivestrent Fivestment Menimum rakExpected relum in octimJim Markowitz is enroiled in a prestigious MBA program and participates in a student investment fund competition. A total investment amount of $ is allocated to his portfolio, and he has three investment options to choose from. The expected returns from the three investment options are and respectively. One of the competition criteria is to ensure that each portfolio has a minimum return of but to increase his chance of advancing to the second round, Jim needs to minimize the investment risk of his portfolio. He uses the following formula to estimate his portfolio's risk:

where and are the proportion of his budget of $in Help Jim formulate this problem as an NLP model and answer the following questions. Use of the total investment amount as an initial value for and

a How much money should Jim invest in each of the three investment options? What are the minimum risk and expected return from the portfolio?

Note: Round "Minimum risk" to decimal places and other answers to decimal places.

tableInvestment Investment Investment Mirimum risk,Expected return in dollars,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock