Question: Jim Push, a manager for Marvy Co., has weekly earnings subject to deductions for Social Security, Medicare, and FIT. Before this payroll, Jim has

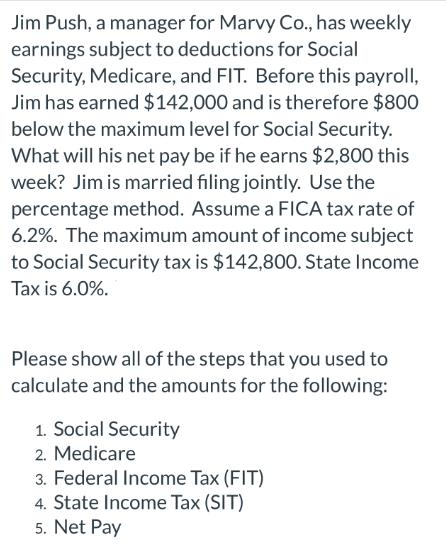

Jim Push, a manager for Marvy Co., has weekly earnings subject to deductions for Social Security, Medicare, and FIT. Before this payroll, Jim has earned $142,000 and is therefore $800 below the maximum level for Social Security. What will his net pay be if he earns $2,800 this week? Jim is married filing jointly. Use the percentage method. Assume a FICA tax rate of 6.2%. The maximum amount of income subject to Social Security tax is $142,800. State Income Tax is 6.0%. Please show all of the steps that you used to calculate and the amounts for the following: 1. Social Security 2. Medicare 3. Federal Income Tax (FIT) 4. State Income Tax (SIT) 5. Net Pay

Step by Step Solution

There are 3 Steps involved in it

1 Social Security Jims earnings for the week is 2800 Since his total earnings before this payroll is ... View full answer

Get step-by-step solutions from verified subject matter experts