Question: Jim Smith operates a roller skating center. He has just received the monthly bank statement at January 31 from Cilizen National Bank, and the statement

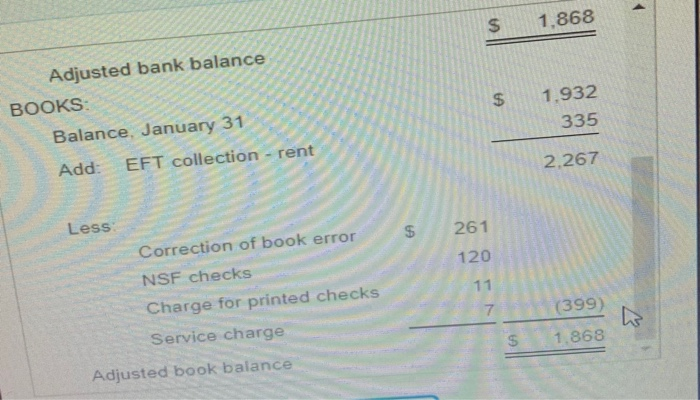

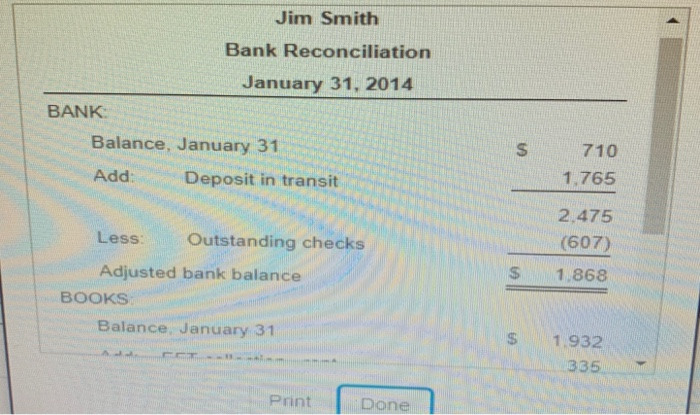

Jim Smith operates a roller skating center. He has just received the monthly bank statement at January 31 from Cilizen National Bank, and the statement shows an ending balance of $710 Listed on the statement are an EFT rent collection of $335, a service charge of $7, two NSF checks totaling $120, and an $11 charge for printed checks In reviewing his cash records, Smith identifies outstanding checks totaling $607 and a January 31 deposit in transit of $1,765. During January, he recorded a $290 check for the salary of a part-time emplayee as 529 Smith's Cash account shows a January 31 balance of $1,932 E (Click the icon to view the bank reconciliation ) Requirement 1. Use the bank reconciliation provided to make the journal entries that Smith should record on January 31 to update his Cash account. Include an explanation for each entry Date Accounts and Explanations Debit Credit 31 Cash Jan 1,868 Adjusted bank balance BOOKS: 1,932 $ Balance, January 31 335 EFT collection - rent Add: 2,267 Less: Correction of book error 261 120 NSF checks Charge for printed checks 11 (399) 7 Service charge 1,868 Adjusted book balance Jim Smith Bank Reconciliation January 31, 2014 BANK: Balance, January 31 710 1,765 Add: Deposit in transit 2.475 (607) Outstanding checks Less: 1,868 Adjusted bank balance BOOKS Balance, January 31 $ 1.932 335 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts