Question: Joan Bradham is a performance analyst for US - based Garnet Portfolio Management. While reviewing the historical performance of the firm's equity investments, she makes

Joan Bradham is a performance analyst for USbased Garnet Portfolio Management. While reviewing the historical

performance of the firm's equity investments, she makes the following statements.

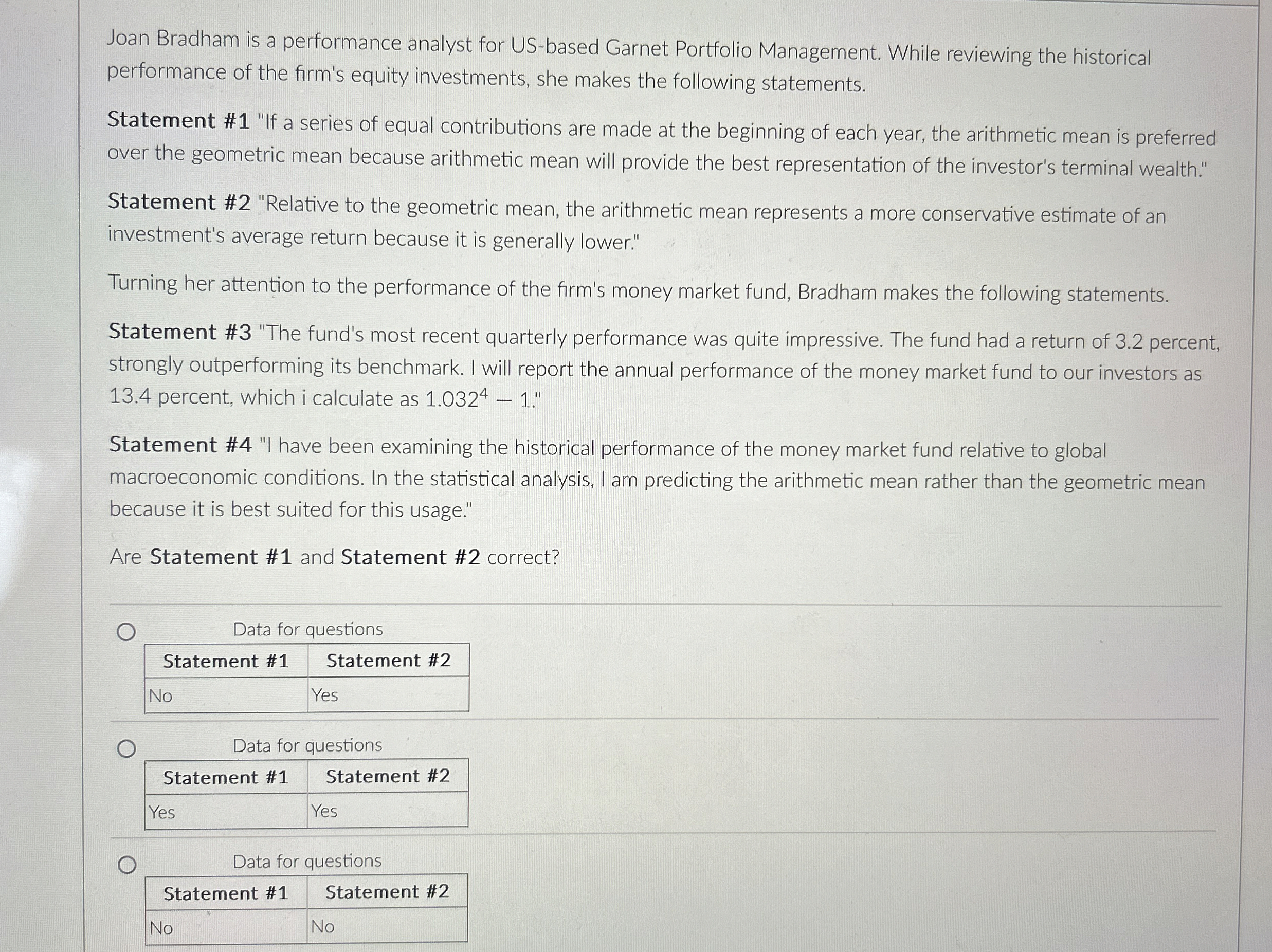

Statement #If a series of equal contributions are made at the beginning of each year, the arithmetic mean is preferred

over the geometric mean because arithmetic mean will provide the best representation of the investor's terminal wealth."

Statement # "Relative to the geometric mean, the arithmetic mean represents a more conservative estimate of an

investment's average return because it is generally lower."

Turning her attention to the performance of the firm's money market fund, Bradham makes the following statements.

Statement # "The fund's most recent quarterly performance was quite impressive. The fund had a return of percent,

strongly outperforming its benchmark. I will report the annual performance of the money market fund to our investors as

percent, which i calculate as

Statement # "I have been examining the historical performance of the money market fund relative to global

macroeconomic conditions. In the statistical analysis, I am predicting the arithmetic mean rather than the geometric mean

because it is best suited for this usage."

Are Statement # and Statement # correct?

Data for questions

Data for questions

Data for questions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock