Question: John ( 6 5 years old ) requested his IRP 6 from SARS for the purpose of provisional tax. The taxable indicated on the IRP

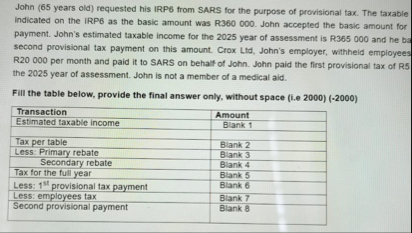

John years old requested his IRP from SARS for the purpose of provisional tax. The taxable indicated on the IRP as the basic amount was R John accepted the basic amount for payment. John's estimated taxable income for the year of assessment is R and he bs second provisional tax payment on this amount. Crox Lid, John's employer, withheld employees R per month and paid it to SARS on behalf of John. John paid the first provisional tax of R the year of assessment. John is not a member of a medical aid.

Fill the table below, provide the final answer only, without space ie

tableTransactionAmountEstimated taxable income,Blank Tax per table,Blank Less: Primary rebate,Blank Secondary rebate,Blank Tax for the full year,Blank Less: provisional tax payment,Blank Less: employees tax,Blank Second provisional payment,Blank

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock