Question: John, a sole trader, received his bank statement for the year ended 31 March 2022. At that date, it showed that his balance in the

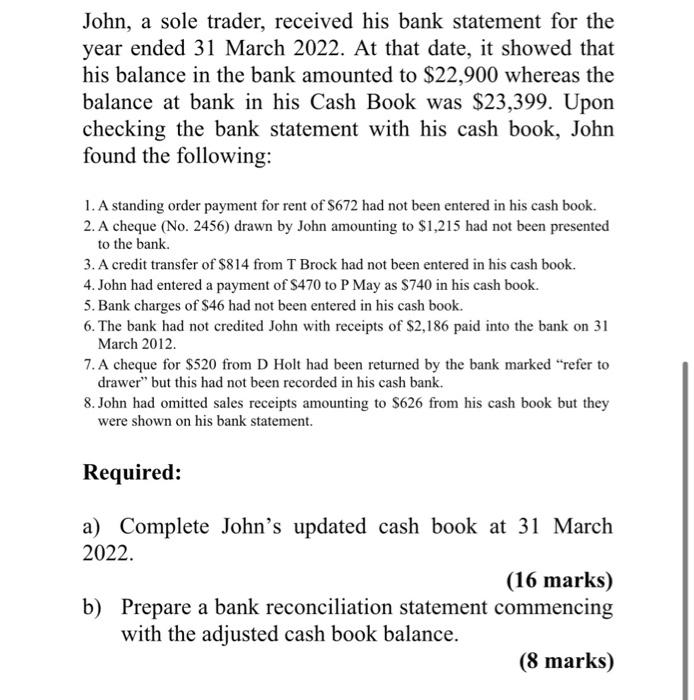

John, a sole trader, received his bank statement for the year ended 31 March 2022. At that date, it showed that his balance in the bank amounted to $22,900 whereas the balance at bank in his Cash Book was $23,399. Upon checking the bank statement with his cash book, John found the following: 1. A standing order payment for rent of $672 had not been entered in his cash book. 2. A cheque (No. 2456) drawn by John amounting to $1,215 had not been presented to the bank. 3. A credit transfer of $814 from T Brock had not been entered in his cash book. 4. John had entered a payment of $470 to P May as $740 in his cash book. 5. Bank charges of $46 had not been entered in his cash book. 6. The bank had not credited John with receipts of $2,186 paid into the bank on 31 March 2012. 7. A cheque for $520 from D Holt had been returned by the bank marked "refer to drawer" but this had not been recorded in his cash bank. 8. John had omitted sales receipts amounting to $626 from his cash book but they were shown on his bank statement. Required: a) Complete John's updated cash book at 31 March 2022 . (16 marks) b) Prepare a bank reconciliation statement commencing with the adjusted cash book balance. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts