Question: John, age 10, found an old baseball glove while exploring an old shed on the property of his new home. His Father, Jerome took

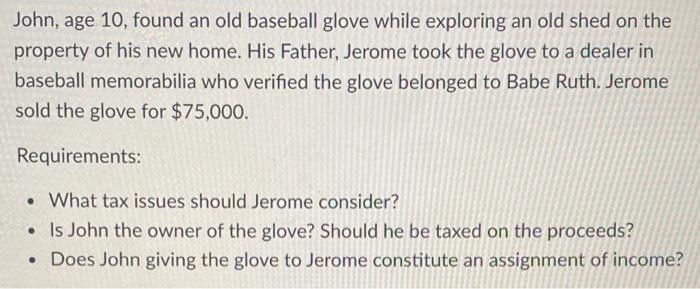

John, age 10, found an old baseball glove while exploring an old shed on the property of his new home. His Father, Jerome took the glove to a dealer in baseball memorabilia who verified the glove belonged to Babe Ruth. Jerome sold the glove for $75,000. Requirements: What tax issues should Jerome consider? Is John the owner of the glove? Should he be taxed on the proceeds? Does John giving the glove to Jerome constitute an assignment of income?

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Answers Tax issues to be considered by Jerome Property or money found should be considered as taxabl... View full answer

Get step-by-step solutions from verified subject matter experts