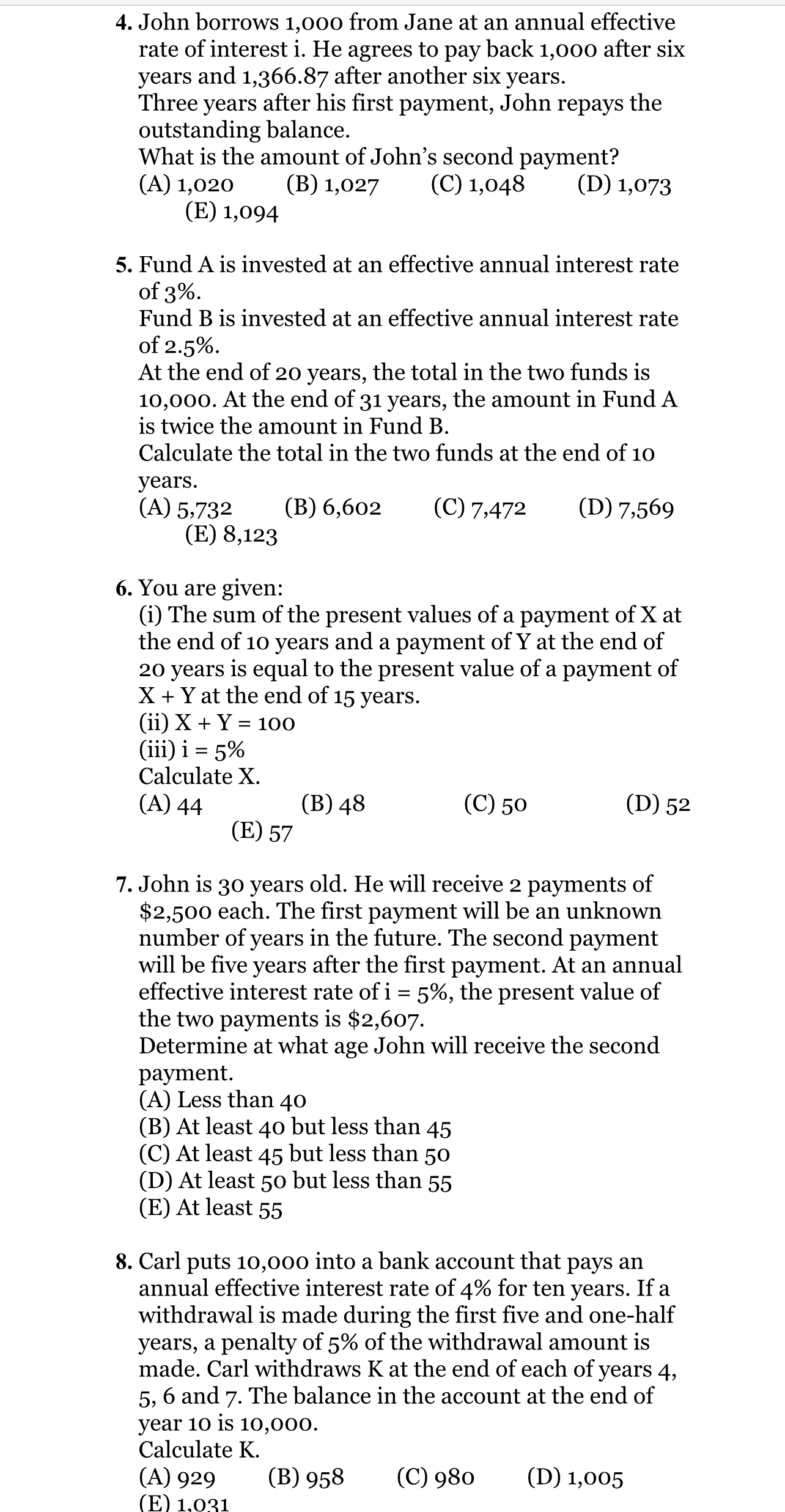

Question: John borrows 1 , 0 0 o from Jane at an annual effective rate of interest i . He agrees to pay back 1 ,

John borrows o from Jane at an annual effective rate of interest i He agrees to pay back o after six years and after another six years.

Three years after his first payment, John repays the outstanding balance.

What is the amount of John's second payment?

A

B

C

D

E

Fund A is invested at an effective annual interest rate of

Fund B is invested at an effective annual interest rate of

At the end of years, the total in the two funds is At the end of years, the amount in Fund A is twice the amount in Fund B

Calculate the total in the two funds at the end of years.

A

B

C

D

E

You are given:

i The sum of the present values of a payment of X at the end of years and a payment of at the end of years is equal to the present value of a payment of at the end of years.

ii

iii

Calculate X

A

B

C

D

E

John is years old. He will receive payments of $ each. The first payment will be an unknown number of years in the future. The second payment will be five years after the first payment. At an annual effective interest rate of the present value of the two payments is $

Determine at what age John will receive the second payment.

A Less than

B At least but less than

C At least but less than

D At least but less than

E At least

Carl puts into a bank account that pays an annual effective interest rate of for ten years. If a withdrawal is made during the first five and onehalf years, a penalty of of the withdrawal amount is made. Carl withdraws K at the end of each of years and The balance in the account at the end of year is

Calculate K

A

B

C

D

E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock