Question: John Financial Services performs bookkeeping and tax - reporting services to startup companies in the Oconomowoc area. On January 1 , 2 0 2 5

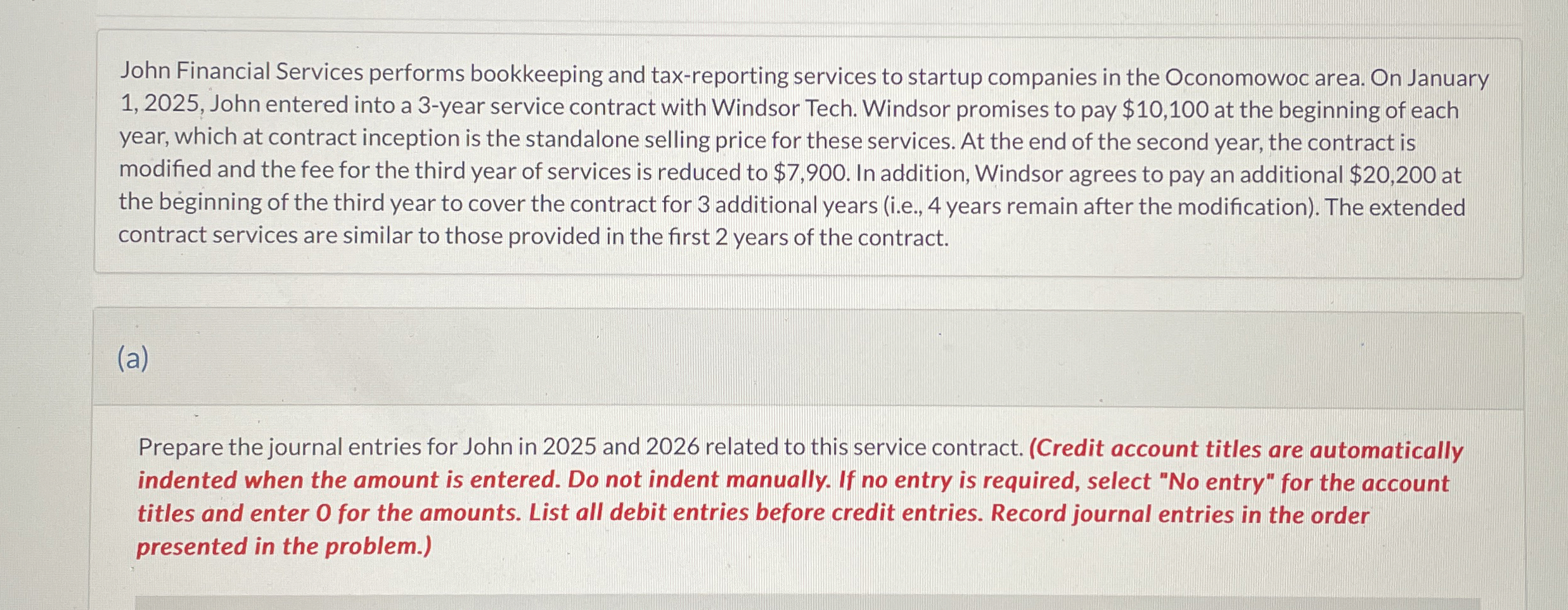

John Financial Services performs bookkeeping and taxreporting services to startup companies in the Oconomowoc area. On January John entered into a year service contract with Windsor Tech. Windsor promises to pay $ at the beginning of each year, which at contract inception is the standalone selling price for these services. At the end of the second year, the contract is modified and the fee for the third year of services is reduced to $ In addition, Windsor agrees to pay an additional $ at the beginning of the third year to cover the contract for additional years ie years remain after the modification The extended contract services are similar to those provided in the first years of the contract.

a

Prepare the journal entries for John in and related to this service contract. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No entry" for the account titles and enter for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock