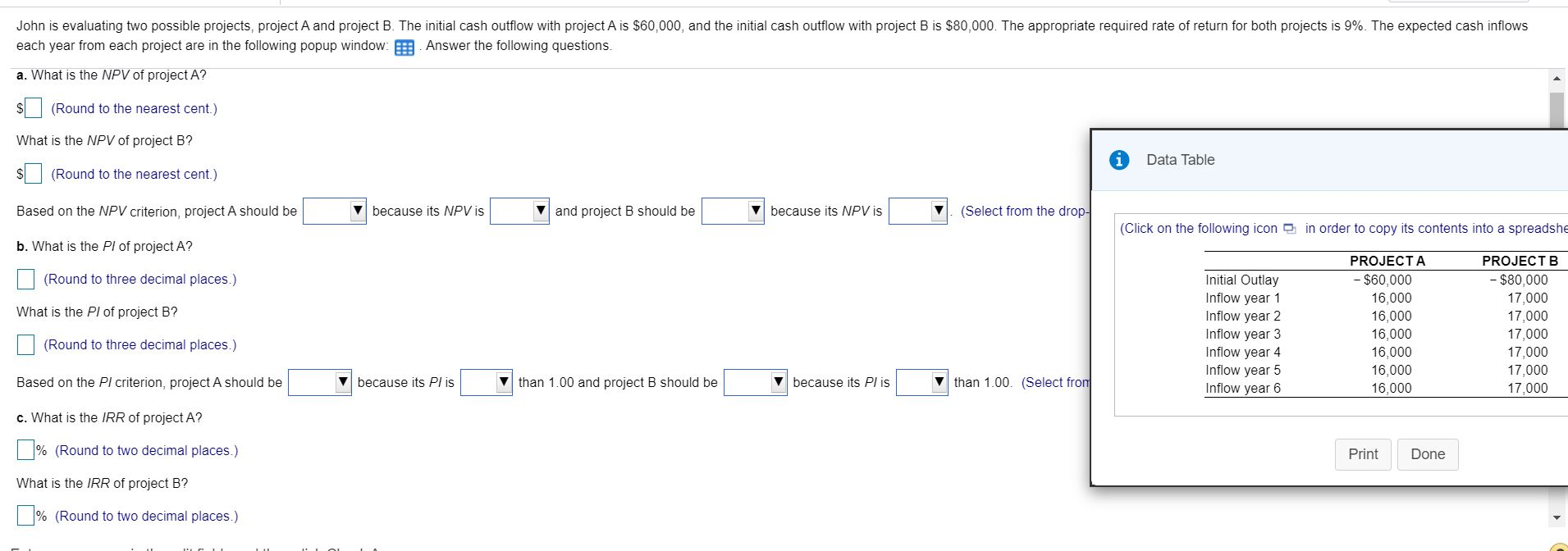

Question: John is evaluating two possible projects, project A and project B. The initial cash outflow with project A is $60,000, and the initial cash outflow

John is evaluating two possible projects, project A and project B. The initial cash outflow with project A is $60,000, and the initial cash outflow with project B is $80,000. The appropriate required rate of return for both projects is 9%. The expected cash inflows each year from each project are in the following popup window: Answer the following questions. a. What is the NPV of project A? (Round to the nearest cent.) What is the NPV of project B? Data Table (Round to the nearest cent.) Based on the NPV criterion, project A should be because its NPV is and project B should be because its NPV is (Select from the drop- (Click on the following icon in order to copy its contents into a spreadshe b. What is the PI of project A? (Round to three decimal places.) What is the PI of project B? Initial Outlay Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 Inflow year 6 PROJECTA - $60,000 16,000 16,000 16,000 16,000 16,000 16,000 PROJECTB - $80,000 17,000 17,000 17,000 17,000 17,000 17,000 (Round to three decimal places.) Based on the Pl criterion, project A should be because its Pl is than 1.00 and project B should be because its Pl is than 1.00. (Select fron c. What is the IRR of project A? % (Round to two decimal places.) Print Done What is the IRR of project B? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts