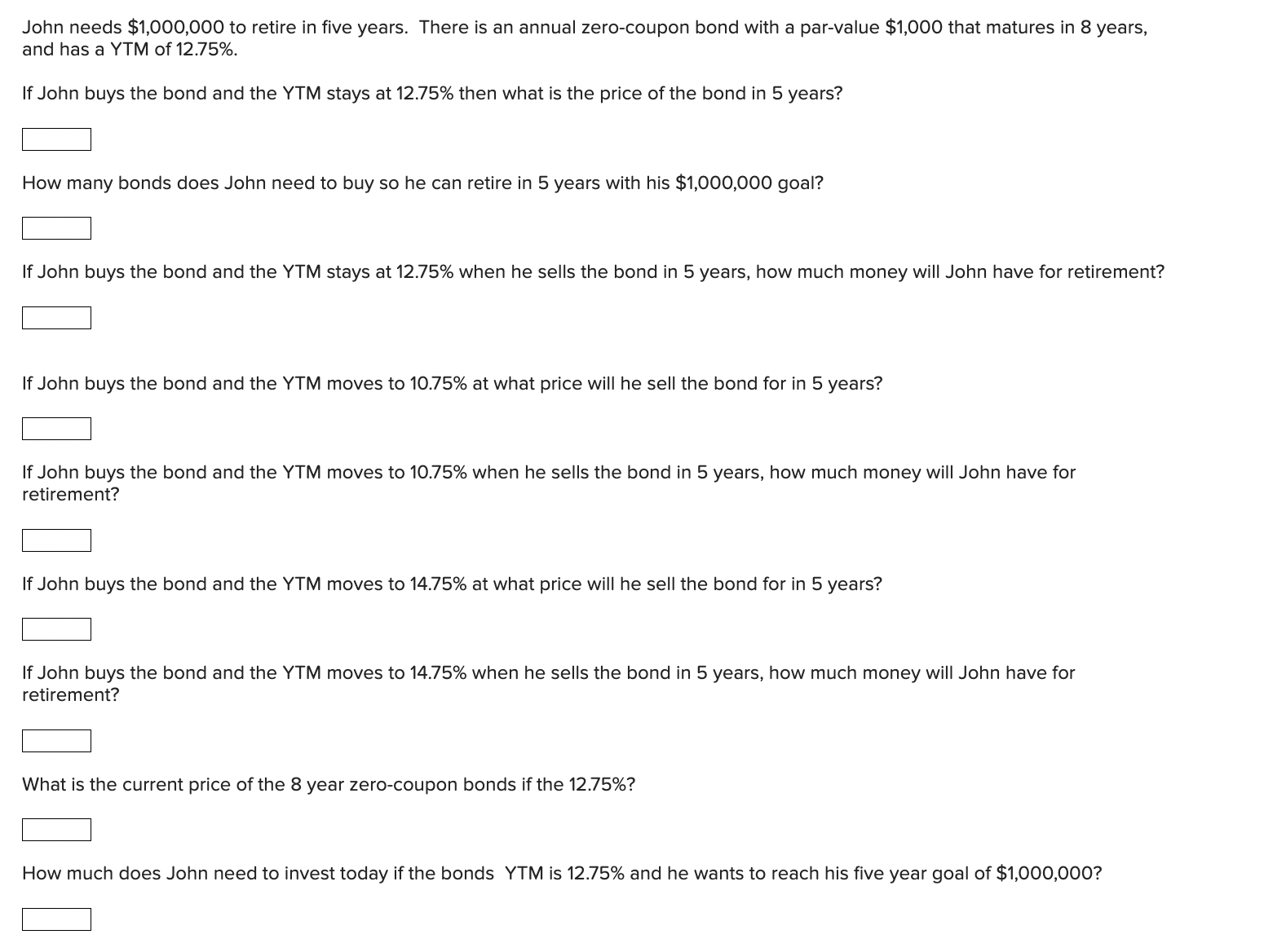

Question: John needs $ 1 , 0 0 0 , 0 0 0 to retire in five years. There is an annual zero - coupon bond

John needs $ to retire in five years. There is an annual zerocoupon bond with a parvalue $ that matures in years,

and has a YTM of

If John buys the bond and the YTM stays at then what is the price of the bond in years?

How many bonds does John need to buy so he can retire in years with his $ goal?

If John buys the bond and the YTM stays at when he sells the bond in years, how much money will John have for retirement?

If John buys the bond and the YTM moves to at what price will he sell the bond for in years?

If John buys the bond and the YTM moves to when he sells the bond in years, how much money will John have for

retirement?

If John buys the bond and the YTM moves to at what price will he sell the bond for in years?

If John buys the bond and the YTM moves to when he sells the bond in years, how much money will John have for

retirement?

What is the current price of the year zerocoupon bonds if the

How much does John need to invest today if the bonds YTM is and he wants to reach his five year goal of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock