Question: John Parsons ( 1 2 3 - 4 5 - 6 7 8 1 ) and George Smith ( 1 2 3 - 4 5

John Parsons and George Smith are and owners, respectively, of Premium, Inc. a candy company located at th Street, Cut and Shoot, TX Premium's S election was made on January its date of incorporation. The following information was taken from the company's income statement.

Interest income $

Gross sales receipts

Beginning inventory

Direct labor

Direct materials purchased

Direct other costs

Ending inventory

Salaries and wages

Officers' salaries $ each to Parsons and Smith

Repairs

Depreciation expense, tax and book

Interest expense

Rent expense operating

Taxes

Charitable contributions cash

Advertising expenses

Payroll penalties

Other deductions

Book income

A comparative balance sheet appears below.

January December

Cash $ $

Accounts receivable

Inventories

Prepaid expenses

Building and equipment

Accumulated depreciation

Land

Total assets $ $

Accounts payable $ $

Notes payable less than year

Notes payable more than year

Capital stock shares outstanding

Retained earnings $

Total liabilities and capital $ $

Premium's accounting firm provides the following additional information.

Distributions to shareholders not reported on Form DIV and

made based on percentage of ownership:

$

Beginning balance, Accumulated adjustments account:

Ordinary business income for QBI:

W wages for QBI:

UBIA of qualified property

Required:

Prepare Premium's Form S Additional Information Continuation Statement, and Schedule Ks for John Parsons and George Smith, th Street, Cut and Shoot, TX

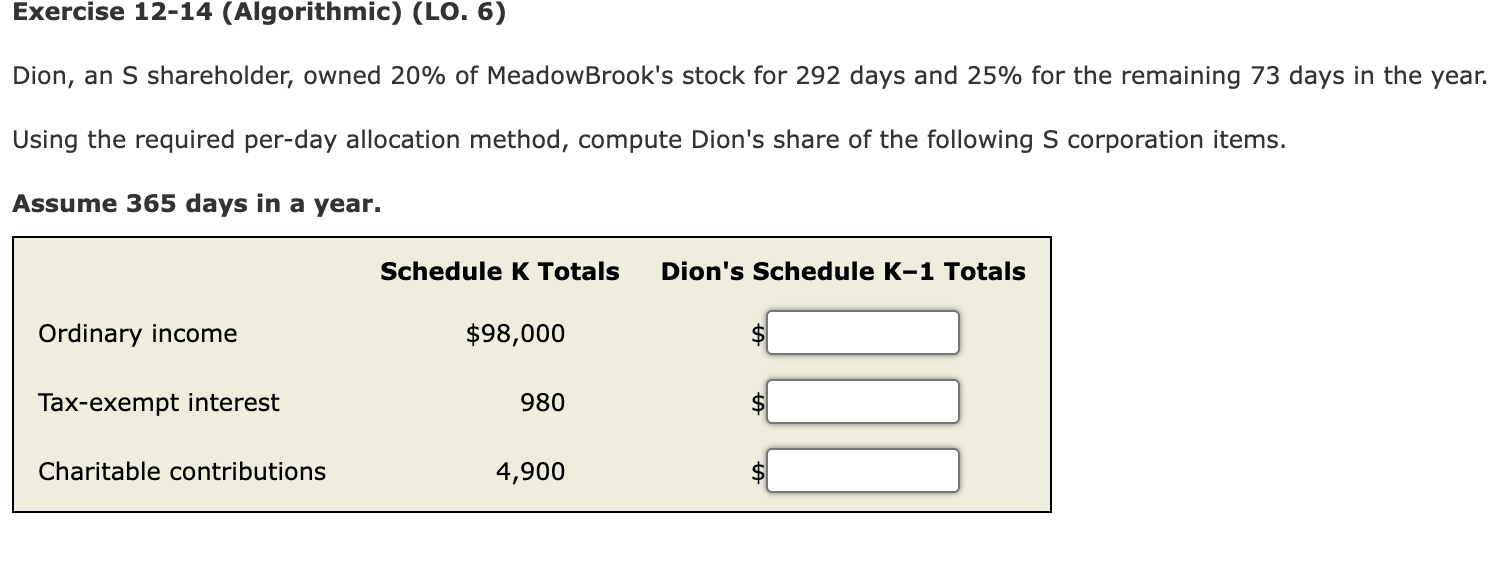

Exercise AlgorithmicLO

Dion, an S shareholder, owned of MeadowBrook's stock for days and for the remaining days in the year.

Using the required perday allocation method, compute Dion's share of the following S corporation items.

Assume days in a year. Schedule K for George Smith

Prepare the Schedule K for George Smith.

If required, round amounts to the nearest dollar.

Note:

Box : Code A is is to report cash charitable contributions.

Box : Code is used to report nondeductible expenses, and Code is used to report distributions not reported on Form DIV.

Box : Code A is used to report Investment income, Code AC is used to report gross receipts for Section c purposes.

Box : Code is used to report information required for the QBI deduction. You are not required to provide a statement of the QBI items.

Final K

Amended K

OMB No

Schedule K

Form S

Department of the Treasury

Internal Revenue Service

beginning

Shareholder's Share of Income, Deductions,

Credits, etc.

Part I Information About the Corporation

A Corporation's employer identification number

B Corporation's name, address, city, state, and ZIP code

Premium, Inc.

th Street

Cut and Shoot, TX

C IRS Center where corporation filed return

efile Statement AQBI Passthrough Entity Reporting

Complete Statement AQBI Passthrough Entity Reporting Schedule K Box Code V for Premium, Inc.

Statement AQBI Passthrough Entity Reporting Schedule K Box Code V

QBI or qualified PTP items subject to partnerspecific determinations:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock