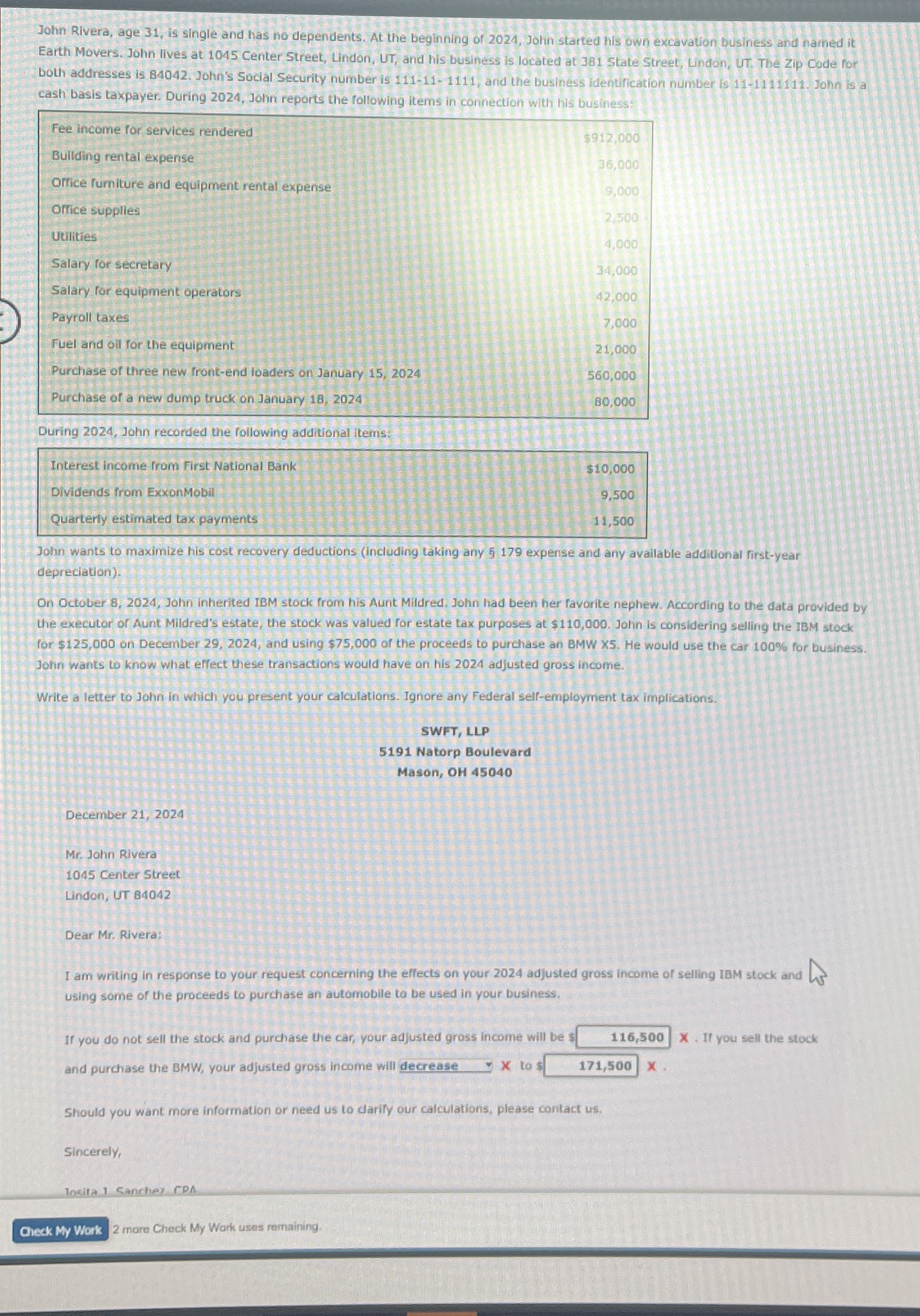

Question: John Rivera, age 3 1 , is single and has no dependents. At the beginning of 2 0 2 4 , John started his own

John Rivera, age is single and has no dependents. At the beginning of John started his own excavation business and hamed it

Earth Movers. John lives at Center Street, Lindon, UT and his business is located at State Street, Lindon, UT The Zip Code for

Doth addresses is John's Social Security number is and the business identification number is John is a

cash basis taxpayer. During John reports the following items in connection with his business:

During John recorded the following additional items:

Johin wants to maximize his cost recovery deductions including taking any expense and any available additional firstyear

depreciation

On October John inherited IBM stock from his Aunt Mildred. John had been her favorite nephew. According to the data provided by

the executor of Aunt Mildred's estate, the stock was valued for estate tax purposes at $ John is considering selling the IBM stock

for $ on December and using $ of the proceeds to purchase an BMW X He would use the car for business.

John wants to know what effect these transactions would have on his adjusted gross income.

Write a letter to John in which you present your calculations. Ignore any Federal selfemployment tax implications.

SWFT LLP

Natorp Boulevard

Mason, OH

December

Mr John Rivera

Center Street

Lindon, UT B

Dear Mr Rivera:

I am writing in response to your request concerning the effects on your adjusted gross income of selling IBM stock and

using some of the proceeds to purchase an automobile to be used in your business.

If you do not sell the stock and purchase the car, your adjusted gross income will bes

X If you sell the stock

and purchase the BMW your adjusted gross income will decrease to

Should you want more information or need us to darify our calculations, please contact us

Sincerely,

Mosita Sianchey CPA

mare Check My Work uses remaining.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock