Question: - John Ward is 26 years old and single. He provides all of his own support. - John works at a grocery store and earned

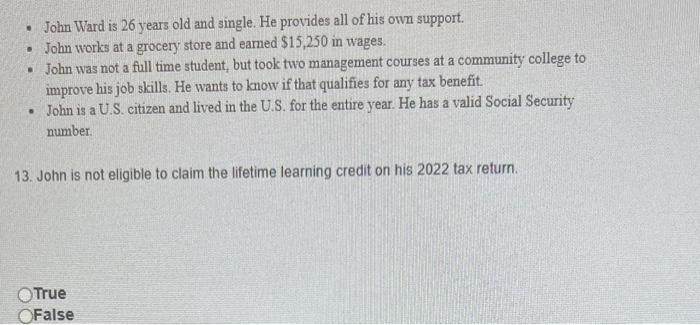

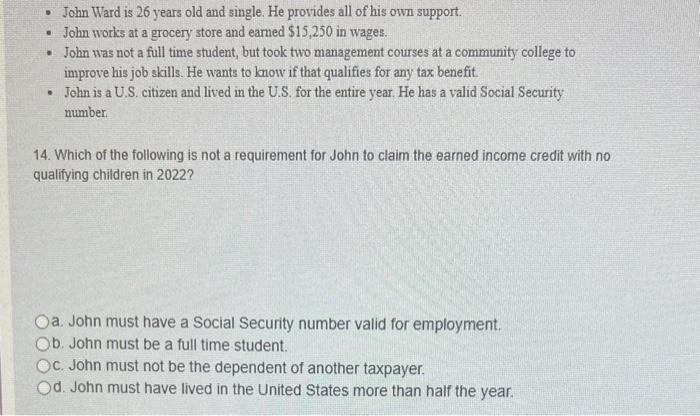

- John Ward is 26 years old and single. He provides all of his own support. - John works at a grocery store and earned $15,250 in wages. - John was not a full time student, but took two management courses at a community college to improve his job skills. He wants to know if that qualifies for any tax benefit. - John is a U.S. citizen and lived in the U.S. for the entire year. He has a valid Social Security number: 13. John is not eligible to claim the lifetime learning credit on his 2022 tax return. True False - John Ward is 26 years old and single. He provides all of his own support. - John works at a grocery store and earned $15,250 in wages. - John was not a full time student, but took two management courses at a community college to improve his job skills. He wants to know if that qualifies for any tax benefit. - John is a U.S. citizen and lived in the U.S. for the entire year. He has a valid Social Security number. 14. Which of the following is not a requirement for John to claim the earned income credit with no qualifying children in 2022 ? a. John must have a Social Security number valid for employment. b. John must be a full time student. c. John must not be the dependent of another taxpayer. d. John must have lived in the United States more than half the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts