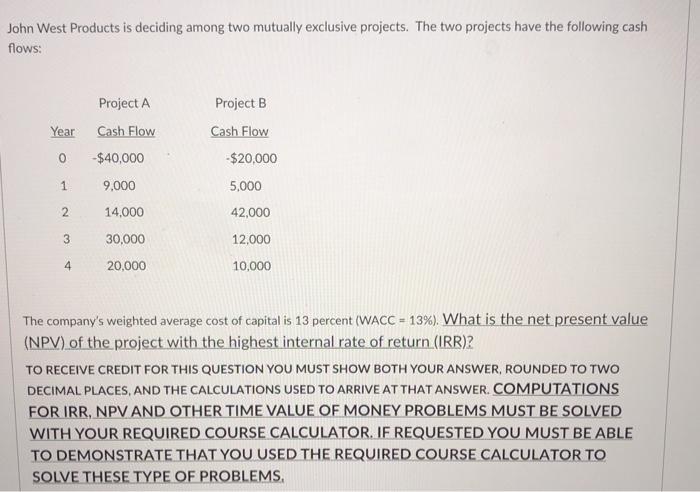

Question: John West Products is deciding among two mutually exclusive projects. The two projects have the following cash flows: Project A Year Cash Flow Project B

John West Products is deciding among two mutually exclusive projects. The two projects have the following cash flows: Project A Year Cash Flow Project B Cash Flow -$20,000 0 -$40,000 1 9.000 5,000 2 14,000 42,000 3 30,000 12,000 4 20,000 10,000 The company's weighted average cost of capital is 13 percent (WACC = 13%). What is the net present value (NPV) of the project with the highest internal rate of return (IRR)? TO RECEIVE CREDIT FOR THIS QUESTION YOU MUST SHOW BOTH YOUR ANSWER, ROUNDED TO TWO DECIMAL PLACES, AND THE CALCULATIONS USED TO ARRIVE AT THAT ANSWER. COMPUTATIONS FOR IRR, NPV AND OTHER TIME VALUE OF MONEY PROBLEMS MUST BE SOLVED WITH YOUR REQUIRED COURSE CALCULATOR. IF REQUESTED YOU MUST BE ABLE TO DEMONSTRATE THAT YOU USED THE REQUIRED COURSE CALCULATOR TO SOLVE THESE TYPE OF PROBLEMS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts