Question: John's Sporting Goods uses the (perpetual) LIFO inventory method. John's Sporting Goods started May with 3 helmets that cost $51 each. On May 19, John's

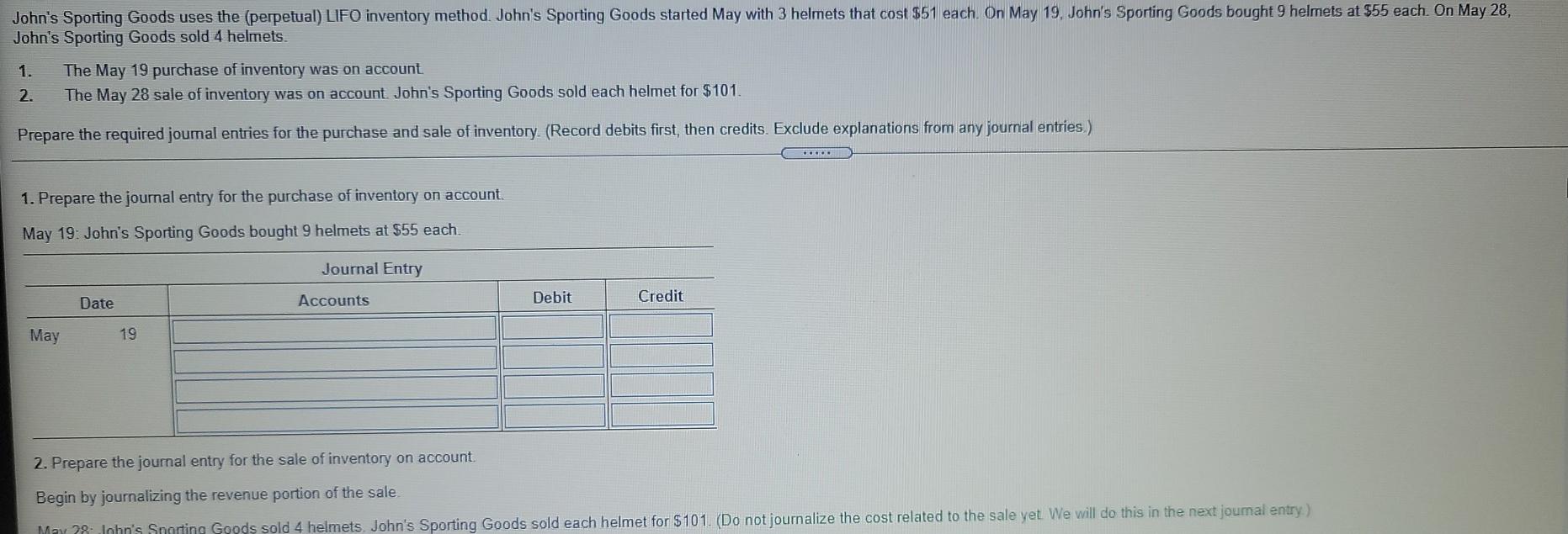

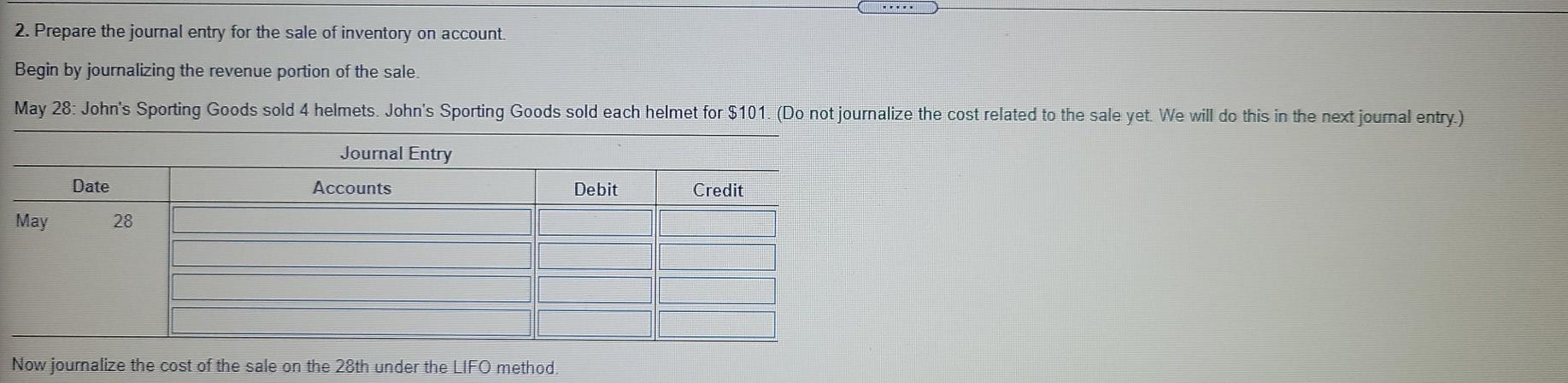

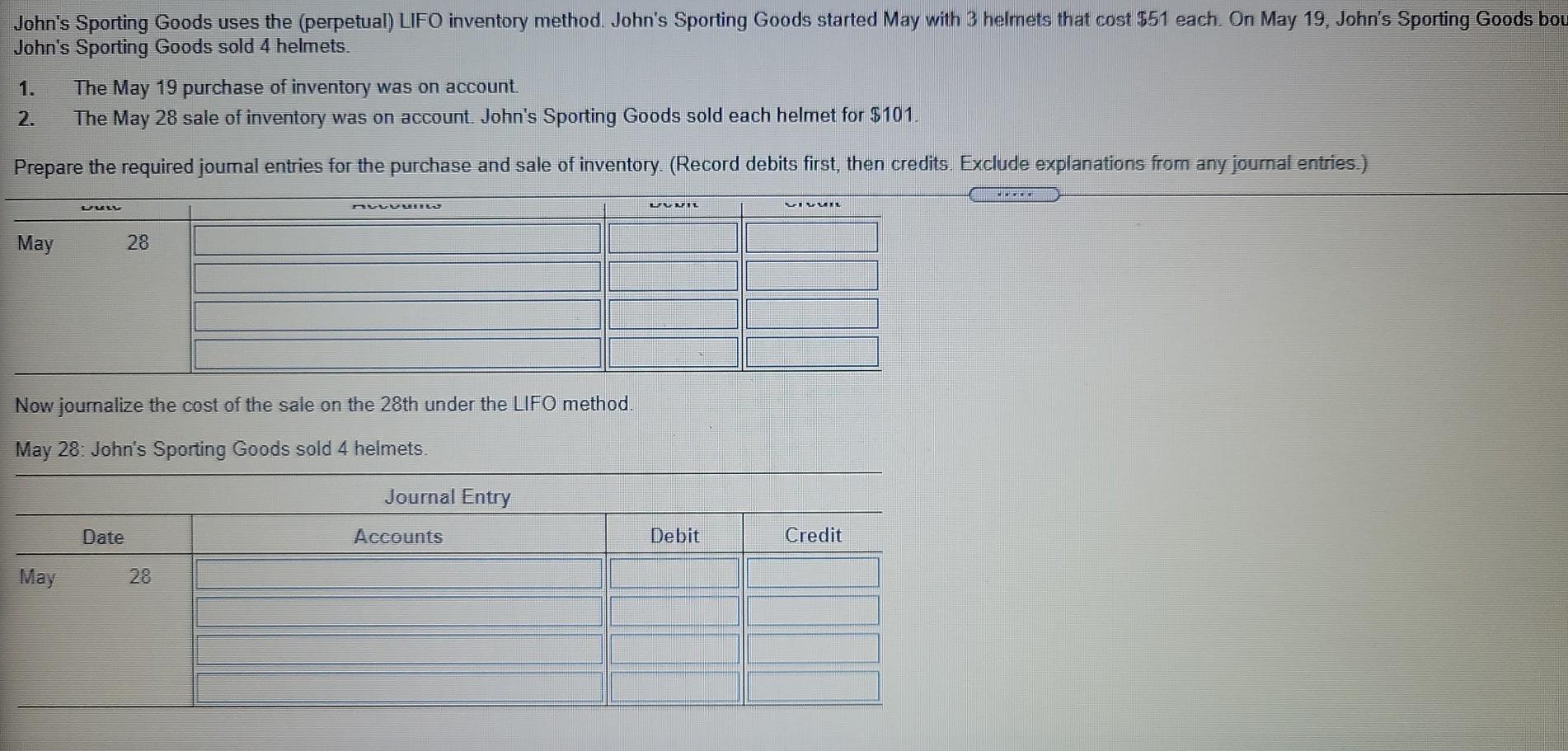

John's Sporting Goods uses the (perpetual) LIFO inventory method. John's Sporting Goods started May with 3 helmets that cost $51 each. On May 19, John's Sporting Goods bought 9 helmets at $55 each. On May 28, John's Sporting Goods sold 4 helmets. 1. The May 19 purchase of inventory was on account. The May 28 sale of inventory was on account John's Sporting Goods sold each helmet for $101. 2. Prepare the required journal entries for the purchase and sale of inventory (Record debits first, then credits. Exclude explanations from any journal entries.) 1. Prepare the journal entry for the purchase of inventory on account May 19: John's Sporting Goods bought 9 helmets at $55 each Journal Entry Date Accounts Debit Credit May 19 2. Prepare the journal entry for the sale of inventory on account Begin by journalizing the revenue portion of the sale May 28 Inhn's Snorting Goods sold 4 helmets. John's Sporting Goods sold each helmet for $101. (Do not journalize the cost related to the sale yet. We will do this in the next joumal entry) 2. Prepare the journal entry for the sale of inventory on account Begin by journalizing the revenue portion of the sale. May 28: John's Sporting Goods sold 4 helmets. John's Sporting Goods sold each helmet for $101. (Do not journalize the cost related to the sale yet. We will do this in the next joumal entry.) Journal Entry Date Accounts Debit Credit May 28 Now journalize the cost of the sale on the 28th under the LIFO method John's Sporting Goods uses the (perpetual) LIFO inventory method John's Sporting Goods started May with 3 helmets that cost $51 each. On May 19, John's Sporting Goods bou John's Sporting Goods sold 4 helmets. 1. The May 19 purchase of inventory was on account 2. The May 28 sale of inventory was on account. John's Sporting Goods sold each helmet for $101. Prepare the required journal entries for the purchase and sale of inventory. (Record debits first, then credits. Exclude explanations from any journal entries.) ACCUEIL UNIL VIVUIL May 28 Now journalize the cost of the sale on the 28th under the LIFO method. May 28: John's Sporting Goods sold 4 helmets. Journal Entry Date Accounts Debit Credit May 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts