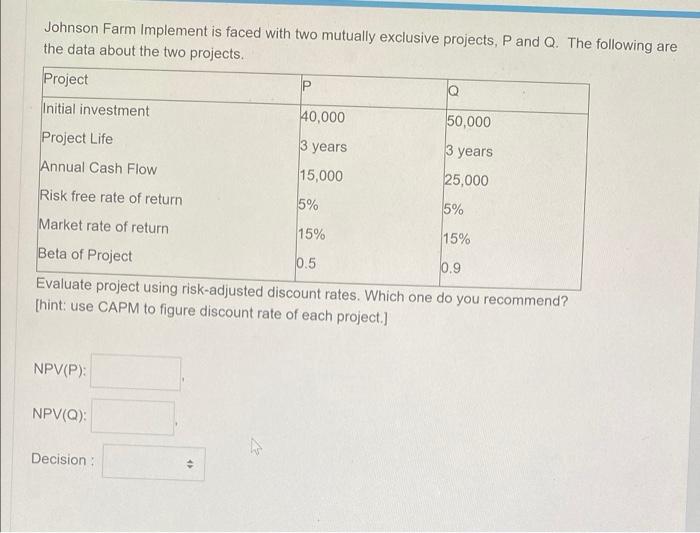

Question: Johnson Farm Implement is faced with two mutually exclusive projects, P and Q. The following are the data about the two projects. Project Q Initial

Johnson Farm Implement is faced with two mutually exclusive projects, P and Q. The following are the data about the two projects. Project Q Initial investment 40,000 50,000 Project Life 3 years 3 years Annual Cash Flow 15,000 Risk free rate of return 25,000 5% 5% Market rate of return 15% 15% Beta of Project 10.5 0.9 Evaluate project using risk-adjusted discount rates. Which one do you recommend? [hint: use CAPM to figure discount rate of each project.] NPV(P); NPV(Q): Decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts