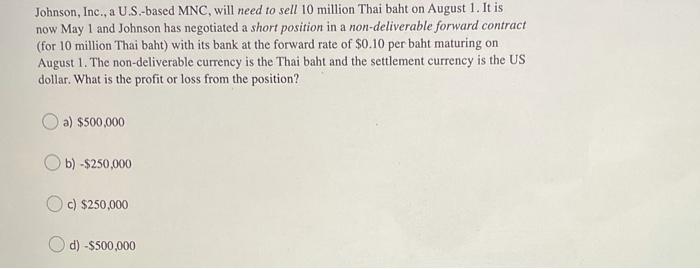

Question: Johnson, Inc., a U.S.-based MNC, will need to sell 10 million Thai baht on August 1. It is now May 1 and Johnson has negotiated

Johnson, Inc., a U.S.-based MNC, will need to sell 10 million Thai baht on August 1. It is now May 1 and Johnson has negotiated a short position in a non-deliverable forward contract (for 10 million Thai baht) with its bank at the forward rate of $0.10 per baht maturing on August 1. The non-deliverable currency is the Thai baht and the settlement currency is the US dollar. What is the profit or loss from the position? a) $500,000 b) -$250,000 c) $250,000 d) -$500,000 Johnson, Inc., a U.S.-based MNC, will need to sell 10 million Thai baht on August 1. It is now May 1 and Johnson has negotiated a short position in a non-deliverable forward contract (for 10 million Thai baht) with its bank at the forward rate of $0.10 per baht maturing on August 1. The non-deliverable currency is the Thai baht and the settlement currency is the US dollar. What is the profit or loss from the position? a) $500,000 b) -$250,000 c) $250,000 d) -$500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts