Question: Johnson & SmithCompany makes custom covers for air conditioning units for homes and businesses. The company uses an activity-based costing system for its overhead costs.

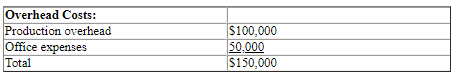

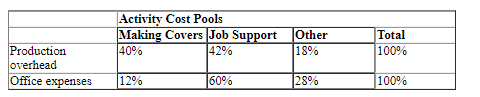

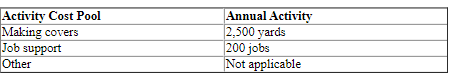

Johnson & SmithCompany makes custom covers for air conditioning units for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools:

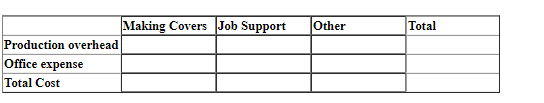

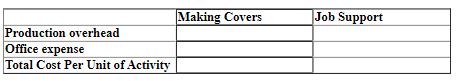

Overhead Costs: Production overhead $100,000 Office expenses 50.000 Total $150.000Activity Cost Pools Making Covers Job Support Other Total Production 40% 42% 18% 100% overhead Office expenses 12% 60% 28% 100%Activity Cost Pool Annual Activity Making covers 2,500 yards Job support 200 jobs Other Not applicableMaking Covers Job Support Other Total Production overhead Office expense Total CostMaking Covers Job Support Production overhead Office expense Total Cost Per Unit of Activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts