Question: Johnson Tire Distributors has debt with both a face and a market value of $157,500,000. This debt has a coupon rate of 9 percent and

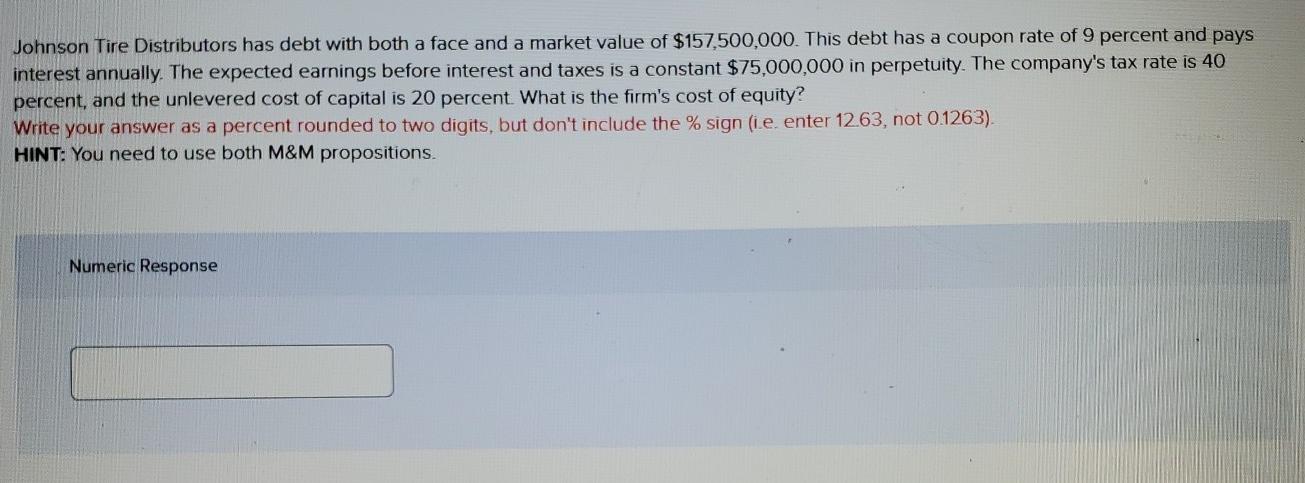

Johnson Tire Distributors has debt with both a face and a market value of $157,500,000. This debt has a coupon rate of 9 percent and pays interest annually. The expected earnings before interest and taxes is a constant $75,000,000 in perpetuity. The company's tax rate is 40 percent, and the unlevered cost of capital is 20 percent. What is the firm's cost of equity? Write your answer as a percent rounded to two digits, but don't include the % sign (ie enter 1263, not 01263) HINT: You need to use both M&M propositions. Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts