Johnson Trucking Company wants to determine a fuel surcharge to add to its customers' bills based...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

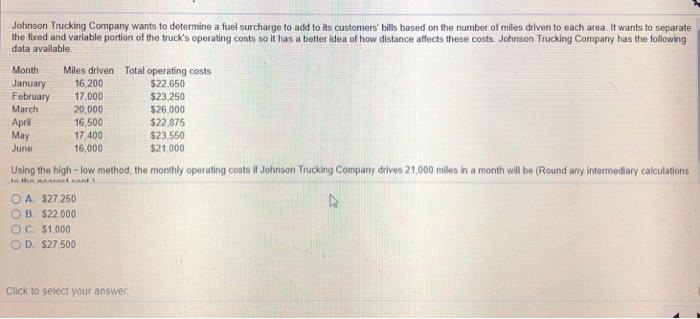

Johnson Trucking Company wants to determine a fuel surcharge to add to its customers' bills based on the number of miles driven to each area. It wants to separate the fixed and variable portion of the truck's operating costs so it has a better idea of how distance affects these costs. Johnson Trucking Company has the following data available. Miles driven Total operating costs 16,200 17,000 20,000 16,500 17,400 16,000 Month January February March $22,650 $23,250 $26,000 $22,875 $23,550 April May June $21.000 Using the high - low method, the monthly operating costa if Johnson Trucking Company drives 21,000 miles in a month will be (Round any intermediary calculations O A. $27,250 O B. $22,000 OC. $1,000 O D. $27,500 Click to select your answer Johnson Trucking Company wants to determine a fuel surcharge to add to its customers' bills based on the number of miles driven to each area. It wants to separate the fixed and variable portion of the truck's operating costs so it has a better idea of how distance affects these costs. Johnson Trucking Company has the following data available. Miles driven Total operating costs 16,200 17,000 20,000 16,500 17,400 16,000 Month January February March $22,650 $23,250 $26,000 $22,875 $23,550 April May June $21.000 Using the high - low method, the monthly operating costa if Johnson Trucking Company drives 21,000 miles in a month will be (Round any intermediary calculations O A. $27,250 O B. $22,000 OC. $1,000 O D. $27,500 Click to select your answer

Expert Answer:

Related Book For

Elementary Statistics A step by step approach

ISBN: 978-0073386102

8th edition

Authors: Allan Bluman

Posted Date:

Students also viewed these accounting questions

-

A large insurance company wants to determine whether there is a difference in the average time to process claim forms among its four different processing facilities. The data in Table 10.5.1...

-

The East Coast University uses a printing machine, the FL200, to print exam papers. According to the operation manual, FL200 can prints 2000 sets of exam papers per hour when it is operating at peak...

-

A large multinational banking company wants to determine whether there is a significant difference in the average dollar amounts purchased by users of different types of credit cards. Among the...

-

In seawater, the pressure p is related to the depth d according to 33p - 18d = 495 where d is in feet and p is in pounds per square inch. (a) Solve this equation for p in terms of d. (b) The Titanic...

-

What are the major differences between an informal reorganization and reorganization in bankruptcy? In answering this question, be sure to discuss the following items: (1) Common pool problem (2)...

-

The class is divided into groups of five. Each team will provide Danjczek with a set of recommendations as to what he should do in his new job to improve the ethical climate at Titan. Depending on...

-

Manage time effectively

-

On June 30, 2009, County Company issued 12% bonds with a par value of $800,000 due in 20 years. They were issued at 98 and were callable at 104 at any date after June 30, 2017. Because of lower...

-

The Nashville Geetars, a professional foosball team, has just signed its star player Harold "The Wrist" Thornton to a new contract. One of the terms requires the team to make a lump sum payment of...

-

Jerry tested 30 laptop computers owned by classmates enrolled in a large computer-science class and discovered that 22 were infected with keystroke-tracking spyware. Is it appropriate for Jerry to...

-

Michael's, Incorporated, just paid $2.10 to its shareholders as the annual dividend. Simultaneously, the company announced that future dividends will be increasing by 4.6 percent. If you require a...

-

The following information appears in the records of Poco Corporation at year-end: a. Calculate the amount of retained earnings at year-end. b. If the amount of the retained earnings at the beginning...

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B D Beginning Assets... $38,000 $22,000 $38,000 ? Liabilities.. 22,000 15,000...

-

On December 31, John Bush completed his first year as a financial planner. The following data are available from his accounting records: a. Compute John's net income for the year just ended using the...

-

Statement of Stockholders' Equity and Balance Sheet The following is balance sheet information for Flush Janitorial Service, Inc., at the end of 2019 and 2018: Required a. Prepare a balance sheet as...

-

Petty Corporation started business on January 1, 2019. The following information was compiled by Petty's accountant on December 31, 2019: Required a. You have been asked to assist the accountant for...

-

Whitetea Company earned net income of $90,000 during the year ended December 31, 2024. On December 15, Whitetea declared the annual cash dividend on its 6% preferred stock (par value, $100,000) and a...

-

The nitrogen atoms in N2 participate in multiple bonding, whereas those in hydrazine, N2H4, do not. (a) Draw Lewis structures for both molecules. (b) What is the hybridization of the nitrogen atoms...

-

The average price of a personal computer (PC) is $949. If the computer prices are approximately normally distributed and = $100, what is the probability that a randomly selected PC costs more than...

-

Find the area under the standard normal distribution curve for each a. Between z = 0 and z = 1.95 b. Between z = 0 and z = 0.37 c. Between z = 1.32 and z = 1.82 d. Between z = 1.05 and z = 2.05 e....

-

According to the Bureau of Transportation statistics, on-time performance by the airlines is described as follows: Action % of Time On time ........................70.8 National Aviation System delay...

-

Is there an observation that may look as though it is an outlier? Explain. For Exercises 24 and 25, use the scatter plot in Figure 8.23 to answer the questions.

-

Will the value of s be closer to 10, 100, 1000, or 10,000? Why?

-

Will the p-value for the hypothesis test for the existence of a linear relationship between the variables be small or large? Explain.

Study smarter with the SolutionInn App