Question: Jon Smit, working with his investment advisor, is developing a portfolio based on the following stocks: He has decided that his portfolio should meet the

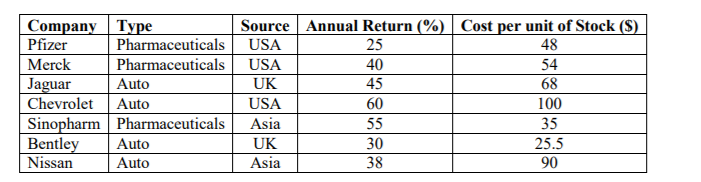

Jon Smit, working with his investment advisor, is developing a portfolio based on the following stocks:

He has decided that his portfolio should meet the following conditions: At least two Pharmaceutical companies At most one Asian stock Exactly one of two UK companies will be included If Jaguar is included then Bentley cannot be included The amount invested in Auto stocks should consist of not more than 50% of the total investment Investment in Pharmaceutical stocks should not exceed 40% of investment in Auto stocks Jon has $5,000,000 to invest in his portfolio. The investment advisor charges a one-time flat fee of $3,000 whenever Jon buys one of the above stocks. Otherwise, the fee is not charged.

Formulate a mixed-integer LP to help Jon maximize his annual returns subject to the above requirements.

48 Company Type Pfizer Pharmaceuticals Merck Pharmaceuticals Jaguar Auto Chevrolet Auto Sinopharm Pharmaceuticals Bentley Auto Nissan Auto Source Annual Return (%) Cost per unit of Stock (S) USA 25 USA 40 54 UK 45 68 USA 60 100 Asia 55 35 UK 30 25.5 Asia 38 90Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts