Question: Jonah's Grooming Services provides pet grooming to multiple kinds of pets. The business completed the following transactions during April 2 0 2 4 : Apr.

Jonah's Grooming Services provides pet grooming to multiple kinds of pets. The business

completed the following transactions during April :

Apr. Jonah's Grooming Services was able to open its doors when the owner, Jonah,

contributed $ cash and an office suite that was worth $ The business

issued Jonah capital in exchange for this contribution. Please show as a compound

journal entry and record the office suite as Building.

Paid $ for an fourmonth insurance policy. The policy begins when the policy

has been paid for.

Groomed German Shepherds for Nina on account for $

Collected $ cash from Circle R Stables to provide horse grooming for the next

months, but Jonah has not yet provided the services.

Paid $ for brushes and clippers. Record these items as Supplies.

Paid the employee wages of $

Purchased a pet bathing station, paying $ on account. Record the station as

Equipment

Collected $ cash from Nina on account.

Received $ for performing various grooming jobs.

Provided additional grooming services on account for $

Paid $ on account.

Paid the light and water bill utilities of $ for the month of December.

Collected the remaining cash from Nina's account.

Jonah withdrew cash of $

Requirements

Record each transaction in the journal using the following chart of accounts.

Explanations are not required.

Post the transactions in the Taccounts.

Prepare an unadjusted trial balance as of April

Journalize the adjusting entries using the following adjustment data and also by

reviewing the journal entries prepared in Requirement Post adjusting entries to the T

accounts.

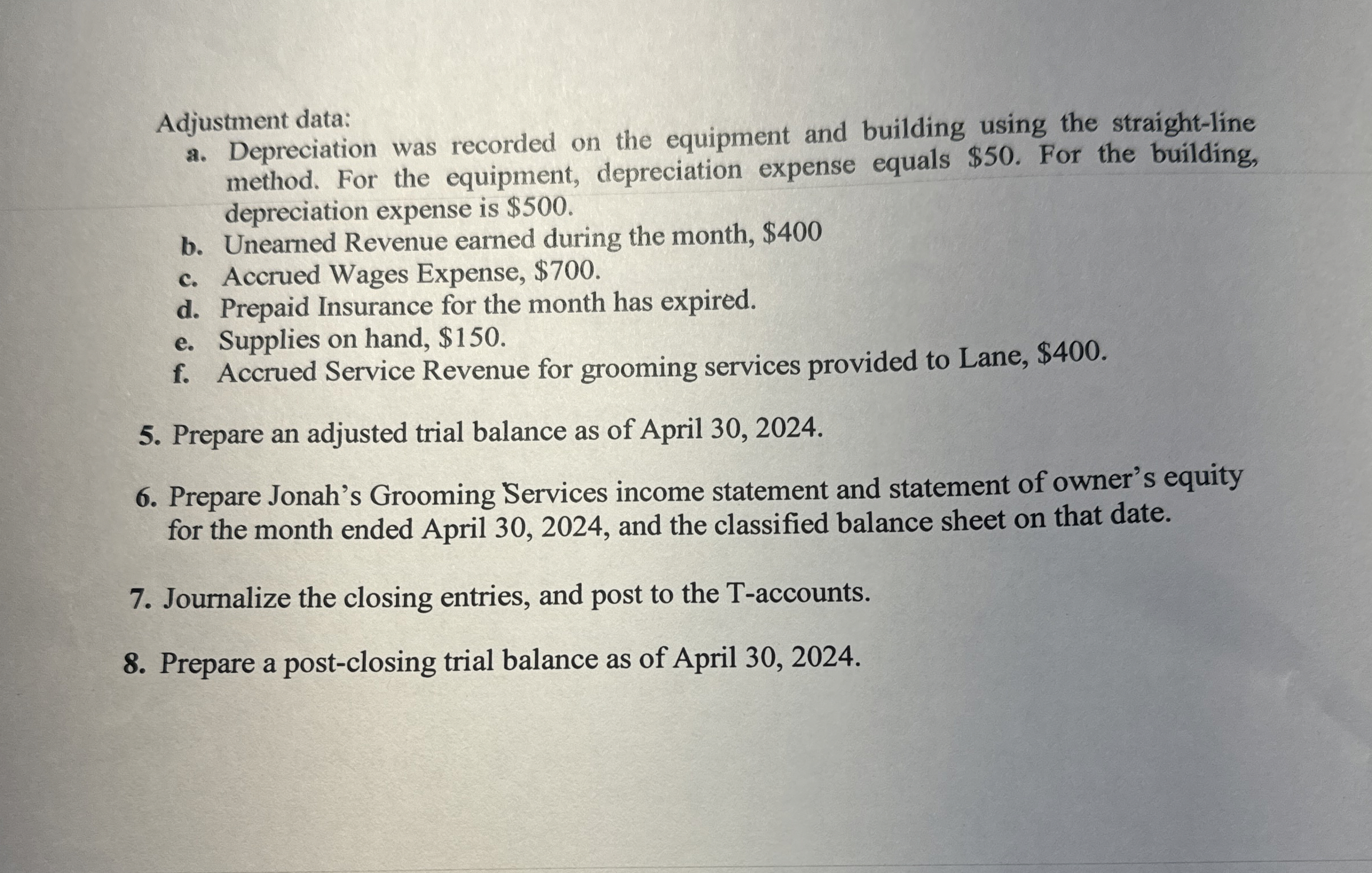

Adjustment data:

a Depreciation was recorded on the equipment and building using the straightline

method. For the equipment, depreciation expense equals $ For the building,

depreciation expense is $

b Unearned Revenue earned during the month, $

c Accrued Wages Expense, $

d Prepaid Insurance for the month has expired.

e Supplies on hand, $

f Accrued Service Revenue for grooming services provided to Lane, $

Prepare an adjusted trial balance as of April

Prepare Jonah's Grooming Services income statement and statement of owner's equity

for the month ended April and the classified balance sheet on that date.

Journalize the closing entries, and post to the Taccounts.

Prepare a postclosing trial balance as of April

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock