Question: Jose gave multiple charitable contributions during the tax year. Which contribution is properly substantiated? Jose donated $ 3 0 0 per week to his church

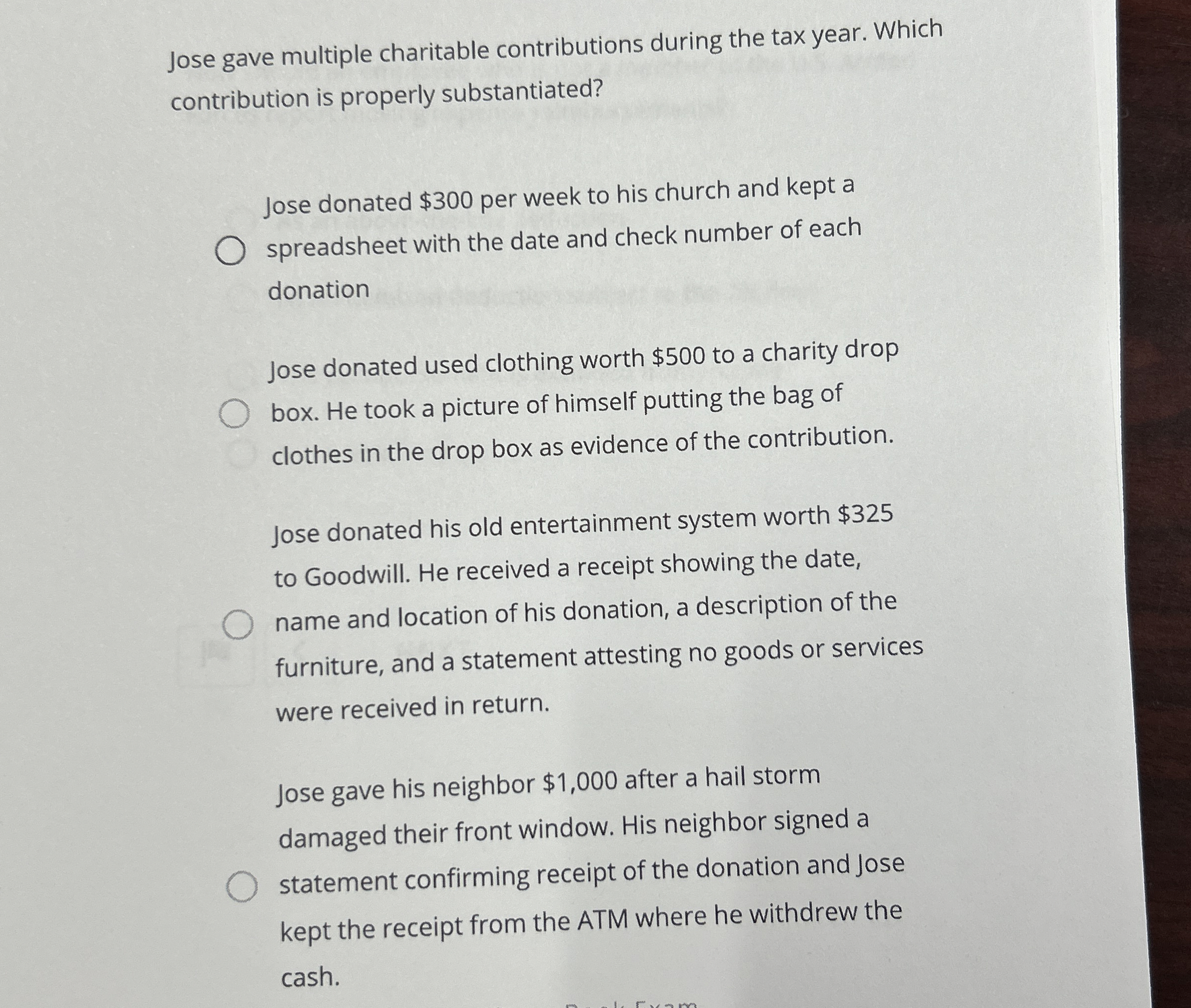

Jose gave multiple charitable contributions during the tax year. Which contribution is properly substantiated?

Jose donated $ per week to his church and kept a spreadsheet with the date and check number of each donation

Jose donated used clothing worth $ to a charity drop box. He took a picture of himself putting the bag of clothes in the drop box as evidence of the contribution.

Jose donated his old entertainment system worth $ to Goodwill. He received a receipt showing the date, name and location of his donation, a description of the furniture, and a statement attesting no goods or services were received in return.

Jose gave his neighbor $ after a hail storm damaged their front window. His neighbor signed a statement confirming receipt of the donation and Jose kept the receipt from the ATM where he withdrew the cash.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

For a charitable contribution to be properly substantiated according to IRS guidelines the donor mus... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock