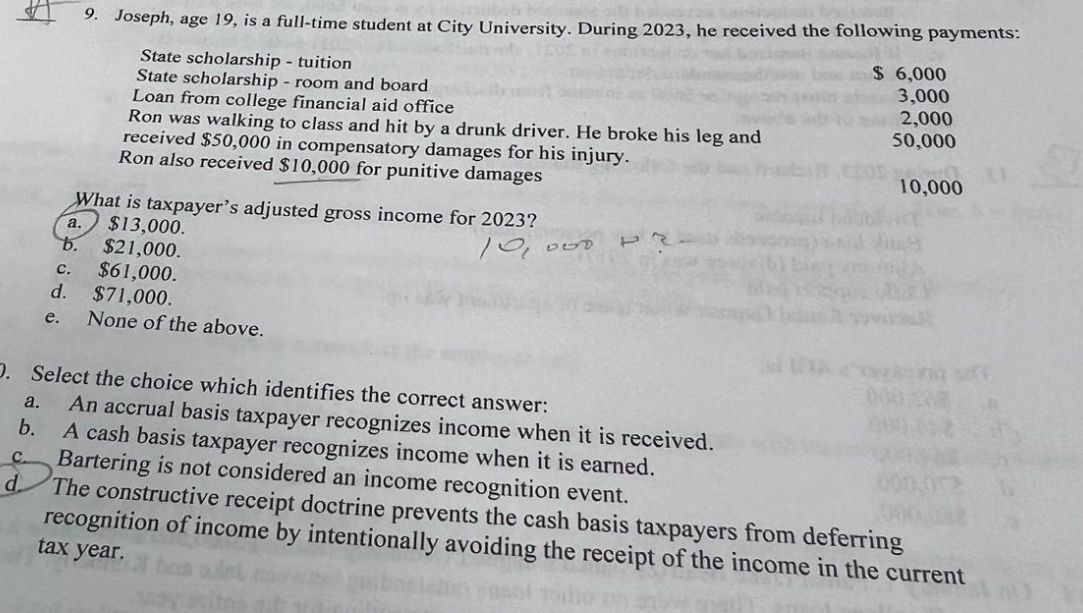

Question: Joseph, age 1 9 , is a full - time student at City University. During 2 0 2 3 , he received the following payments:

Joseph, age is a fulltime student at City University. During he received the following payments:

State scholarship tuition

State scholarship room and board

Loan from college financial aid office

Ron was walking to class and hit by a drunk driver. He broke his leg and received $ in compensatory damages for his injury.

Ron also received $ for punitive damages

$

What is taxpayer's adjusted gross income for

a $

b $

c $

d $

e None of the above.

Select the choice which identifies the correct answer:

a An accrual basis taxpayer recognizes income when it is received.

b A cash basis taxpayer recognizes income when it is earned.

c Bartering is not considered an income recognition event.

d The constructive receipt doctrine prevents the cash basis taxpayers from deferring recognition of income by intentionally avoiding the receipt of the income in the current tax year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock