Question: Joseph Ltd operates two divisions, Alpha and Beta. Currently, Alpha Division manufactures only material A and sells all its output internally to Beta Division.

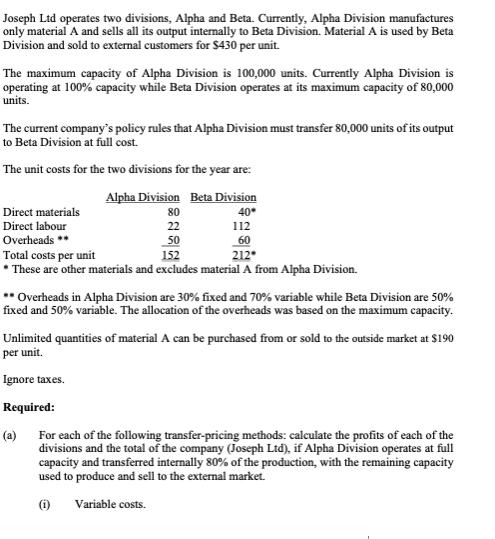

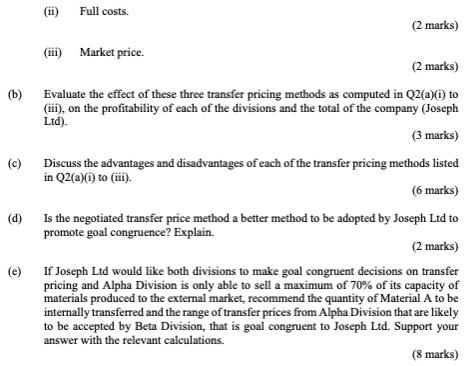

Joseph Ltd operates two divisions, Alpha and Beta. Currently, Alpha Division manufactures only material A and sells all its output internally to Beta Division. Material A is used by Beta Division and sold to external customers for $430 per unit. The maximum capacity of Alpha Division is 100,000 units. Currently Alpha Division is operating at 100% capacity while Beta Division operates at its maximum capacity of 80,000 units. The current company's policy rules that Alpha Division must transfer 80,000 units of its output to Beta Division at full cost. The unit costs for the two divisions for the year are: Alpha Division Beta Division 40 Direct materials Direct labour 80 22 50 112 Overheads ** 60 Total costs per unit 152 212* *These are other materials and excludes material A from Alpha Division. ** Overheads in Alpha Division are 30% fixed and 70% variable while Beta Division are 50% fixed and 50% variable. The allocation of the overheads was based on the maximum capacity. Unlimited quantities of material A can be purchased from or sold to the outside market at $190 per unit. Ignore taxes. Required: For each of the following transfer-pricing methods: calculate the profits of each of the divisions and the total of the company (Joseph Ltd), if Alpha Division operates at full capacity and transferred internally 80% of the production, with the remaining capacity used to produce and sell to the external market. (1) Variable costs. (b) (c) Full costs. (iii) Market price. (2 marks) (2 marks) Evaluate the effect of these three transfer pricing methods as computed in Q2(a)(i) to (iii), on the profitability of each of the divisions and the total of the company (Joseph Ltd). (3 marks) Discuss the advantages and disadvantages of each of the transfer pricing methods listed in Q2(a)(i) to (iii). (6 marks) (d) Is the negotiated transfer price method a better method to be adopted by Joseph Ltd to promote goal congruence? Explain. (2 marks) (e) If Joseph Ltd would like both divisions to make goal congruent decisions on transfer pricing and Alpha Division is only able to sell a maximum of 70% of its capacity of materials produced to the external market, recommend the quantity of Material A to be internally transferred and the range of transfer prices from Alpha Division that are likely to be accepted by Beta Division, that is goal congruent to Joseph Ltd. Support your answer with the relevant calculations. (8 marks)

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

a For each of the following transferpricing methods calculate the profits of each of the divisions and the total of the company Joseph Ltd if Alpha Division operates at full capacity and transferred i... View full answer

Get step-by-step solutions from verified subject matter experts