Question: Josh plans to buy a new multi process welder for his workshop. The machine is expected to make $8000 per year over its 10 -year

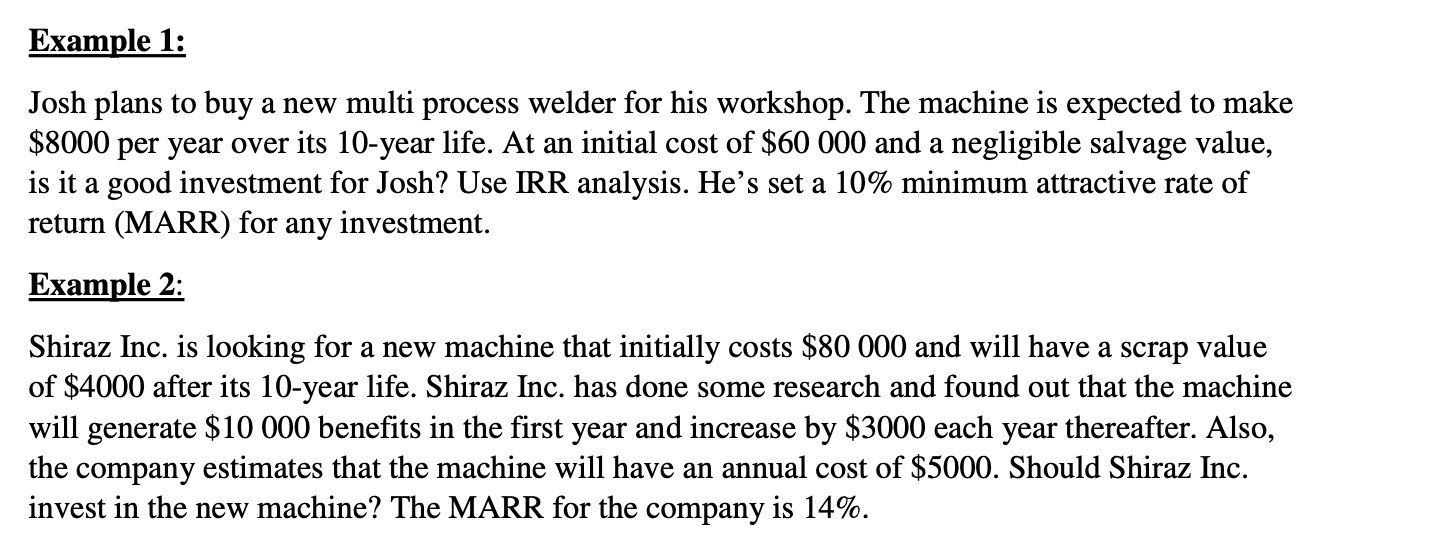

Josh plans to buy a new multi process welder for his workshop. The machine is expected to make $8000 per year over its 10 -year life. At an initial cost of $60000 and a negligible salvage value, is it a good investment for Josh? Use IRR analysis. He's set a 10% minimum attractive rate of return (MARR) for any investment. Example 2: Shiraz Inc. is looking for a new machine that initially costs $80000 and will have a scrap value of $4000 after its 10-year life. Shiraz Inc. has done some research and found out that the machine will generate $10000 benefits in the first year and increase by $3000 each year thereafter. Also, the company estimates that the machine will have an annual cost of $5000. Should Shiraz Inc. invest in the new machine? The MARR for the company is 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts