Question: Journal eneries and T accounts from Problem 1: Plese do the exercise using information above: Adjusting entries: Salaries earned by Starbucks employees that have not

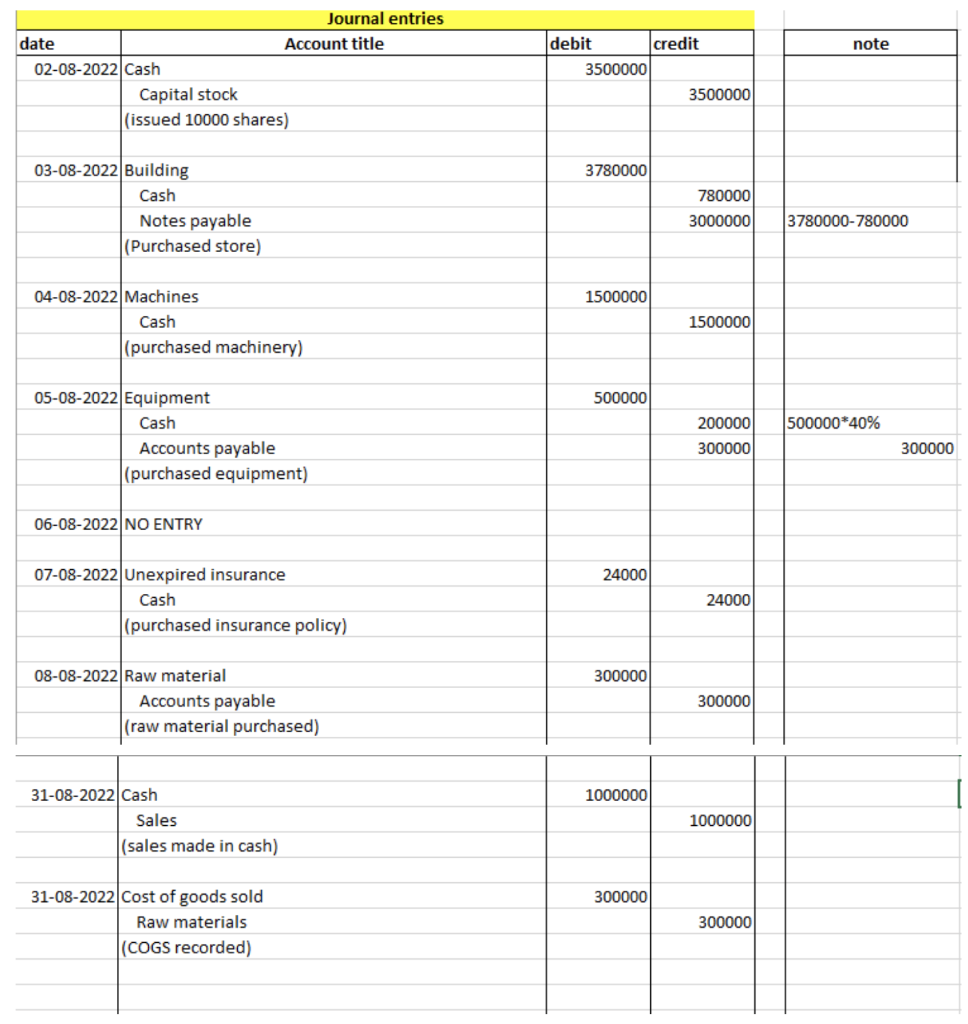

Journal eneries and T accounts from Problem 1:

Plese do the exercise using information above:

Plese do the exercise using information above:

Adjusting entries:

- Salaries earned by Starbucks employees that have not yet been recorded or paid amount to 6.667.

- Depreciation of the building is based on an estimated life of 20 years. The straight-line method is used.

- Depreciation of the machines is based on an estimated life of 10 years. The straight-line method is used.

- Depreciation of the Equipment is based on an estimated life of 10 years. The straight-line method is used.

- Unrecorded Income Taxes Expense accrued in August amounts to 60,000. This amount will not be paid until January 15, 2023.

- No interest expense has been recorded or paid.

- No insurance expense has been recorded or paid.

1) Record the journal entries for the adjusting entries.

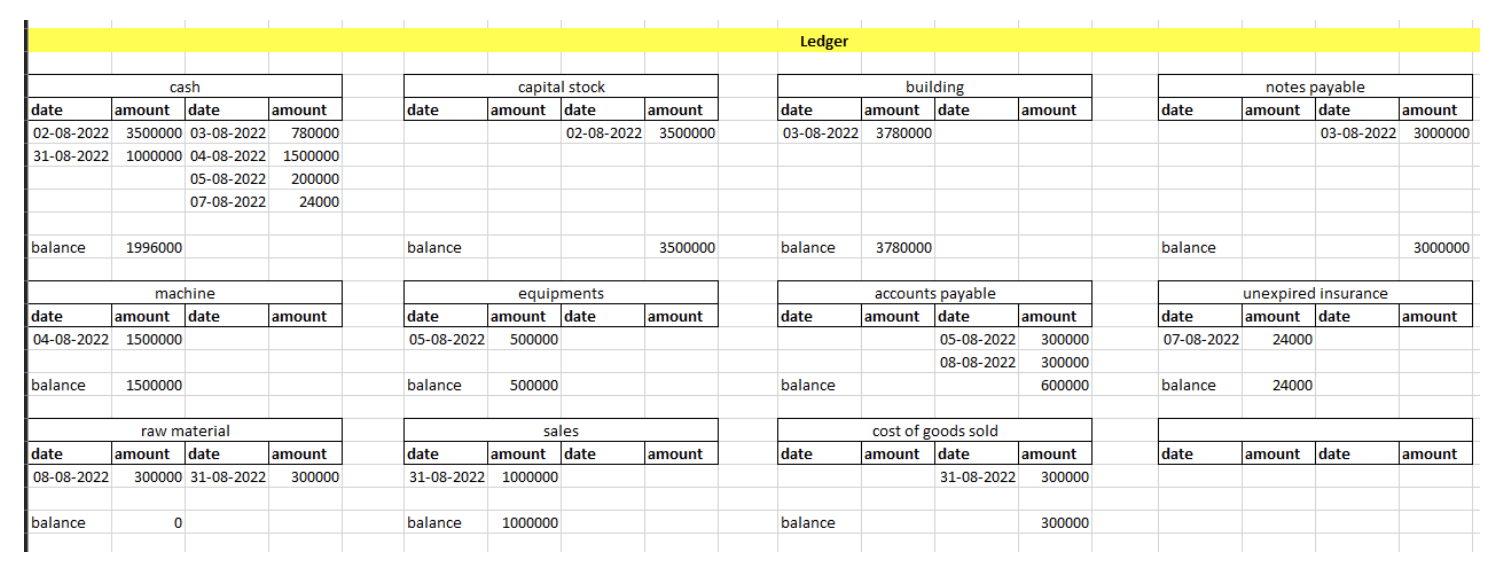

2) Post the adjusting entries onto the appropriate ledger T accounts. Calculate and show the ending balance for each T account (The same T accounts that you have used in problem 1)

2) Post the adjusting entries onto the appropriate ledger T accounts. Calculate and show the ending balance for each T account (The same T accounts that you have used in problem 1)

3) Prepare a trial balance.

Thank you.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock