Question: journal entries and closing entry ha pte Cha Cha Problem 1-Merchandiser Entries - Prepare journal entries to record the following merchandising transactions of Tinkerman Toys,

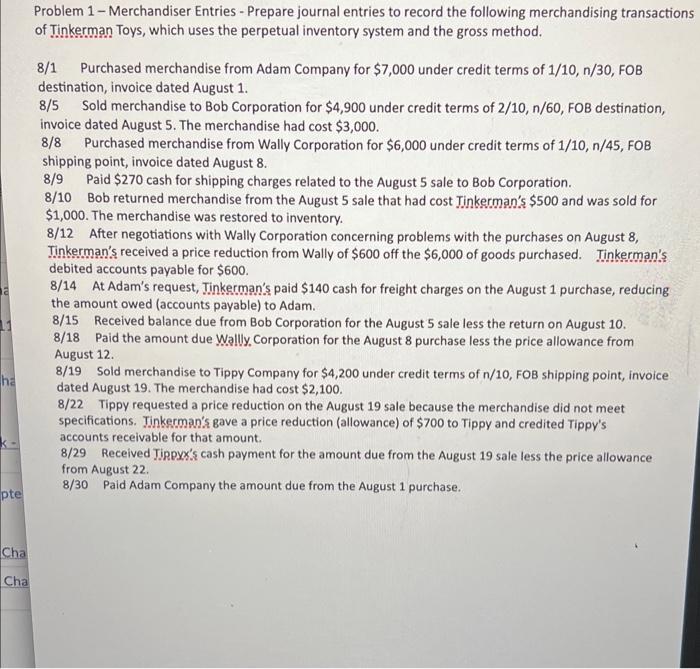

ha pte Cha Cha Problem 1-Merchandiser Entries - Prepare journal entries to record the following merchandising transactions of Tinkerman Toys, which uses the perpetual inventory system and the gross method. 8/1 Purchased merchandise from Adam Company for $7,000 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. 8/5 Sold merchandise to Bob Corporation for $4,900 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost $3,000. 8/8 Purchased merchandise from Wally Corporation for $6,000 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. 8/9 Paid $270 cash for shipping charges related to the August 5 sale to Bob Corporation. 8/10 Bob returned merchandise from the August 5 sale that had cost Tinkerman's $500 and was sold for $1,000. The merchandise was restored to inventory. 8/12 After negotiations with Wally Corporation concerning problems with the purchases on August 8, Tinkerman's received a price reduction from Wally of $600 off the $6,000 of goods purchased. Tinkerman's debited accounts payable for $600. 8/14 At Adam's request, Tinkerman's paid $140 cash for freight charges on the August 1 purchase, reducing the amount owed (accounts payable) to Adam. 8/15 Received balance due from Bob Corporation for the August 5 sale less the return on August 10. 8/18 Paid the amount due Wallly, Corporation for the August 8 purchase less the price allowance from August 12. 8/19 Sold merchandise to Tippy Company for $4,200 under credit terms of n/10, FOB shipping point, invoice dated August 19. The merchandise had cost $2,100. 8/22 Tippy requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Tinkerman's gave a price reduction (allowance) of $700 to Tippy and credited Tippy's accounts receivable for that amount. 8/29 Received Tippyx's cash payment for the amount due from the August 19 sale less the price allowance from August 22. 8/30 Paid Adam Company the amount due from the August 1 purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts